3D Metrology Market Size - By Component (Hardware, Software, Services), By Hardware (Coordinate Measuring Machine (CMM), Optical Digitizer & Scanner (ODS), Video Measuring Machine (VMM), 3D Automated Optical Inspection (AOI) System), By Services (Quality Control & Inspection, Reverse Engineering, Virtual Simulation and 3D Scanning), By End Use (Aerospace, Automotive, Medical, Construction & Engineering, Heavy Machinery, Others) & Region – Forecasts By 2031

- PUBLISHED ON

- 2024-09-07

- NO OF PAGES

- 300

- CATEGORY

- Information Communication & Technology

Market Overview:

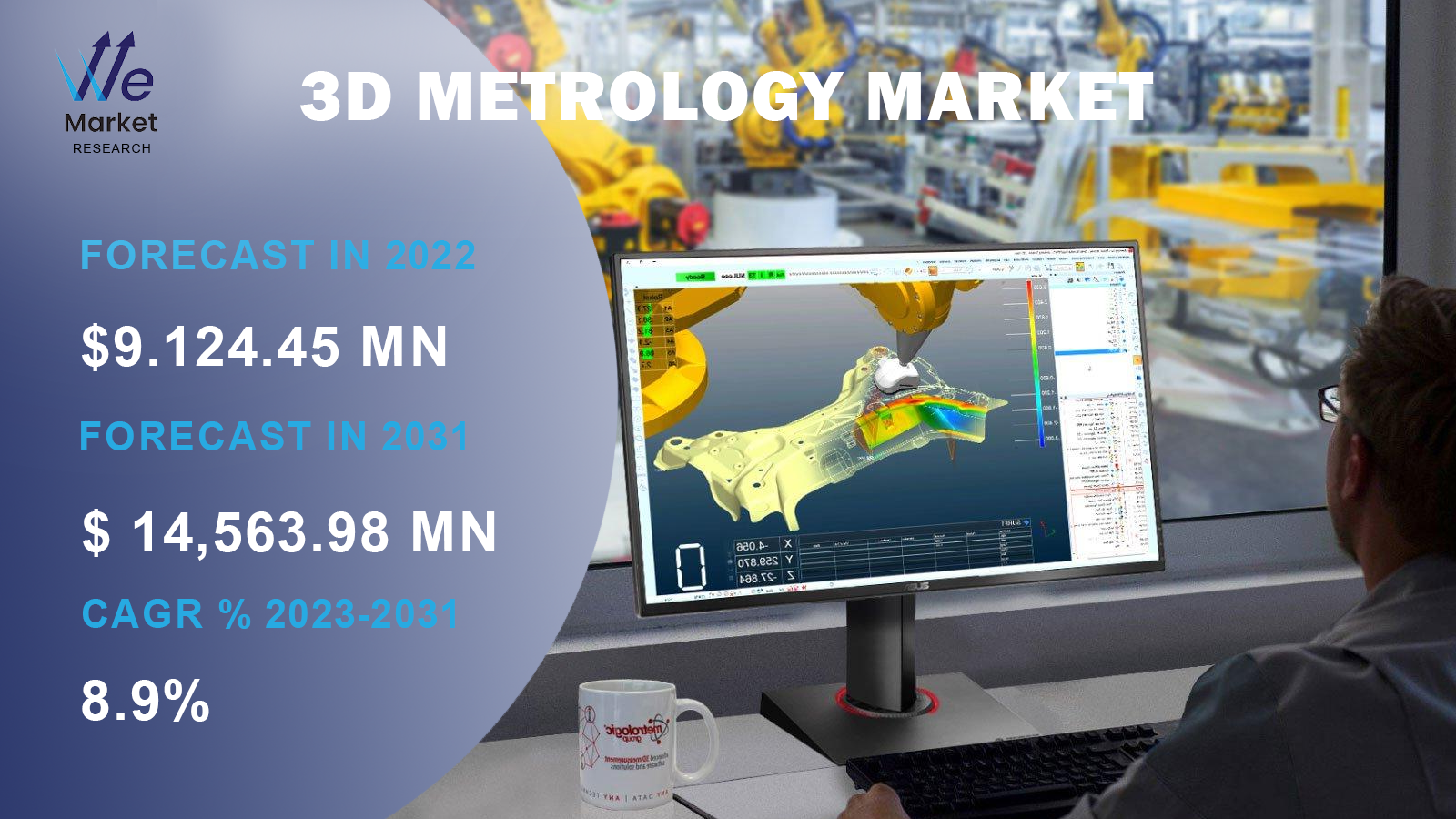

The global 3D Metrology market

was valued at USD 9.124.45 Million in 2022 and expected to grow at a CAGR of 8.9%

during the forecast period. 3D Metrology, also known as three-dimensional

metrology, is a measurement and inspection technique used to accurately assess

the size, shape, and dimensions of objects or components in three dimensions

(length, width, and height). It involves the use of advanced measurement tools

and technologies to capture precise data about the physical characteristics of

objects and to ensure quality control in various industries.

3D Metrology employs a range of measurement tools and technologies,

including:

Coordinate Measuring Machines (CMMs): CMMs are precision

instruments that use probes to measure points on an object's surface and create

a 3D representation of the object's geometry.

3D Scanners: 3D scanners capture the shape and surface details of

objects by capturing data points in three dimensions. They can use laser,

structured light, or other technologies.

Laser Scanners: These devices use laser beams to measure distances

and create 3D point clouds of objects.

Optical Systems: Optical metrology systems use cameras and optics

to capture high-resolution 3D images and perform non-contact measurements.

Computed Tomography (CT) Scanning: CT scanning provides detailed 3D

images of the internal and external structures of objects by taking X-ray

measurements from multiple angles.

Portable Measurement Arms: These are handheld devices with

articulated arms and touch probes for measuring objects with high precision.

3D Metrology has a wide range of applications across various

industries, including:

Manufacturing: Quality control, dimensional inspection, and reverse

engineering of parts and components.

Aerospace: Inspection of aircraft components for safety and

precision.

Automotive: Measurement and validation of vehicle parts and

assemblies.

Medical: Measurement of medical devices, prosthetics, and

patient-specific implants.

Archaeology: Documentation and preservation of historical

artifacts.

Art and Cultural Heritage: Conservation and restoration of artworks

and historical objects.

Construction: Verification of building structures and components

for accuracy and compliance with design specifications.

Geospatial and Surveying: Topographic mapping and land surveying

for urban planning, infrastructure development, and environmental monitoring.

Entertainment and Gaming: Creation of 3D models and environments

for virtual reality and augmented reality applications.

3D Metrology offers several key advantages, including:

Precision: It provides highly accurate and repeatable measurements,

critical for quality control and assurance.

Efficiency: Faster data capture and analysis compared to

traditional manual methods.

Non-Destructive Testing: Many 3D metrology techniques are

non-destructive, allowing the inspection of delicate or valuable objects

without damage.

Digital Documentation: Creation of detailed digital models and

records for analysis, design, or archival purposes.

Cost Savings: Early detection of defects and deviations in

manufacturing can lead to cost savings by reducing scrap and rework.

Industry Standards: Various industry standards and guidelines exist

to ensure consistent and reliable 3D metrology practices in fields like

manufacturing and aerospace.

3D Metrology is a critical tool

for ensuring the quality, accuracy, and reliability of products and components

across diverse industries. Its precision and versatility make it invaluable for

applications ranging from manufacturing and aerospace to medicine and cultural

preservation. Advancements in 3D metrology technology continue to drive

innovation and improve the capabilities of this field.

|

Report

Attributes |

Description |

|

3D Metrology Market

Size in 2022 |

USD 9.124.45 Million |

|

Market Forecast in

2031 |

USD

14,563.98 Million |

|

CAGR % 2023-2031 |

8.9% |

|

Base Year |

2022 |

|

Historic Data |

2019-2021 |

|

Forecast Period |

2023-2031 |

|

Report USP |

Production, Consumption, company share,

company heatmap, company production capacity, growth factors and more |

|

Segments Covered |

By

Component, By End-use |

|

Regional Scope |

North America, Europe, APAC, South America

and Middle East and Africa |

|

Country Scope |

U.S.;

Canada; U.K.; Germany; France; Italy; Spain; Benelux; Nordic Countries;

Russia; China; India; Japan; South Korea; Australia; Indonesia; Thailand;

Mexico; Brazil; Argentina; Saudi Arabia; UAE; Egypt; South Africa; Nigeria |

|

Key Companies |

Carl Zeiss AG, Hexagon AB, FARO Technologies,

Mitutoyo Corporation, Nikon Corporation, KLA-Tencor, and Keyence Corporation |

Covid-19 Impact:

The COVID-19 pandemic has had a

significant impact on the 3D metrology market. The pandemic has led to the

closure of factories and other businesses, which has reduced the demand for 3D

metrology services. In addition, the pandemic has disrupted supply chains,

making it difficult for 3D metrology manufacturers to get the components they

need to produce their products.

However, the pandemic has also

created new opportunities for the 3D metrology industry. The pandemic has led

to an increased focus on automation and digitization, which has created demand

for 3D metrology systems that can be used to monitor and control production

processes. In addition, the pandemic has led to an increased demand for 3D

printing, which has created demand for 3D metrology systems that can be used to

inspect 3D printed objects.

Overall, the COVID-19 pandemic

has had a mixed impact on the 3D metrology industry. The pandemic has led to

some short-term challenges, but it has also created new opportunities for the

long term.

Here are some of the specific

impacts of COVID-19 on the 3D metrology market:

The closure of factories and

other businesses: The closure of factories and other businesses has led to a

decrease in the demand for 3D metrology services. This is because 3D metrology

is often used to inspect and measure products during the manufacturing process.

When factories are closed, there are no products to inspect and measure.

The disruption of supply chains:

The disruption of supply chains has made it difficult for 3D metrology

manufacturers to get the components they need to produce their products. This

is because many of the components that are used in 3D metrology systems are

made in countries that have been affected by the pandemic.

The increased focus on automation

and digitization: The pandemic has led to an increased focus on automation and

digitization. This is because businesses are looking for ways to reduce the

number of people they need to interact with in order to prevent the spread of

the virus. 3D metrology can be used to automate tasks, such as inspection and

measurement, which can help businesses to reduce the number of people they need

to interact with.

The increased demand for 3D

printing: The pandemic has led to an increased demand for 3D printing. This is

because 3D printing can be used to create personal protective equipment (PPE),

such as masks and gloves. 3D metrology can be used to inspect 3D printed

objects to ensure that they meet the required specifications.

Overall, the COVID-19 pandemic

has had a mixed impact on the 3D metrology market. The pandemic has led to some

short-term challenges, but it has also created new opportunities for the long

term. The market is expected to recover from the pandemic and continue to grow

in the coming years.

Market Dynamics:

Drivers:

Growing demand for quality

control and inspection: 3D metrology is used to measure the dimensions, shape,

and surface finish of objects. This information is used to ensure that products

meet quality standards. The increasing demand for quality control and

inspection is driving the demand for 3D metrology market.

Rise of Industry 4.0: Industry

4.0 is a trend towards automation and digitization in manufacturing. 3D

metrology is a key enabling technology for Industry 4.0, as it can be used to

monitor and control the manufacturing process.

Growing use of 3D printing: 3D

printing is a process of creating three-dimensional objects from digital

models. 3D metrology is used to inspect 3D printed objects to ensure that they

meet the desired specifications. The growing use of 3D printing is driving the

demand.

Advancements in 3D metrology

technologies: There have been significant advancements in 3D metrology

technologies in recent years. These advancements have made 3D metrology more

accurate, reliable, and affordable. This is making 3D metrology more accessible

to a wider range of industries.

Increased focus on product

safety: There is an increasing focus on product safety, especially in

industries such as automotive and aerospace. 3D metrology can be used to detect

defects in products that could pose a safety hazard. This is driving the demand

for 3D metrology market.

Restraints:

High cost: 3D metrology systems can be expensive, especially for

high-end models. This can be a barrier to entry for some industries.

Complexity: 3D metrology systems can be complex to operate and

maintain. This can require specialized training and expertise, which can be

costly.

Lack of standardization: There is

no single standard for 3D metrology systems. This can make it difficult to

integrate different systems from different vendors.

Data security: 3D metrology systems can collect a lot of data about

objects. This data can be sensitive and confidential, so it is important to

have security measures in place to protect it.

Skills shortage: There is a shortage of skilled workers in 3D

metrology. This can make it difficult to find and hire qualified personnel to

operate and maintain 3D metrology systems.

Regional Analysis:

North America: North America is the largest market for 3D

metrology, accounting for a share of 35% in 2022. The growth of the 3D

metrology market in North America is driven by the increasing demand for

quality control and inspection in the automotive, aerospace, and medical

industries.

Europe: Europe is the second largest market for 3D metrology,

accounting for a share of 25% in 2022. The growth of the 3D metrology market in

Europe is driven by similar factors as in North America, as well as the

increasing demand for 3D metrology in the electronics and semiconductor

industries.

Asia Pacific: Asia Pacific is the third largest market for 3D

metrology, accounting for a share of 20% in 2022. The growth of the 3D

metrology Industry in Asia Pacific is driven by the growing demand for 3D

metrology in the automotive, electronics, and manufacturing industries.

Latin America: Latin America is the fourth largest market for 3D

metrology, accounting for a share of 10% in 2022. The growth of the 3D

metrology market in Latin America is driven by the increasing demand for 3D

metrology in the automotive and manufacturing industries.

Middle East & Africa: Middle East & Africa is the smallest

market for 3D metrology, accounting for a share of 5% in 2022. The growth of

the 3D metrology industry in Middle East & Africa is driven by the

increasing demand for 3D metrology in the oil & gas and aerospace

industries.

Competitive Landscape:

The global 3D Metrology market is

highly competitive and fragmented with the presence of several players. These

companies are constantly focusing on new product development, partnerships,

collaborations, and mergers and acquisitions to maintain their market position

and expand their geographical presence.

Some of the key players operating in the 3D Metrology market are:

·

Carl Zeiss AG

·

Hexagon AB

·

FARO Technologies

·

Mitutoyo Corporation

·

Nikon Corporation

·

KLA-Tencor

·

Keyence Corporation

·

Perceptron

·

Creaform

·

GOM mbH

·

3D Systems Corporation

·

Others

Segments for 3D Metrology Market

By Component

·

Hardware

·

Software

·

Services

By Hardware

·

Coordinate

Measuring Machine (CMM)

·

Optical

Digitizer & Scanner (ODS)

·

Video

Measuring Machine (VMM)

·

3D

Automated Optical Inspection (AOI) System

By Services

·

Quality

Control & Inspection

·

Reverse

Engineering

·

Virtual

Simulation

·

3D

Scanning

By Application

·

Aerospace

·

Automotive

·

Medical

·

Construction

& Engineering

·

Heavy

Machinery

·

Others

By

Geography

·

North America

o

U.S.

o

Canada

o

Mexico

·

Europe

o

U.K.

o

Germany

o

France

o

Italy

o

Spain

o

Russia

·

Asia-Pacific

o

Japan

o

China

o

India

o

Australia

o

South Korea

o

ASEAN

o

Rest of APAC

·

South America

o

Brazil

o

Argentina

o

Colombia

o

Rest of South America

·

MEA

o

South Africa

o

Saudi Arabia

o

UAE

o

Egypt

o

Rest of MEA

1. Global

3D Metrology Market Introduction and Market Overview

1.1. Objectives

of the Study

1.2. 3D Metrology Market

Definition & Description

1.3. Global

3D Metrology Market Scope and Market Estimation

1.3.1.

Global 3D Metrology Overall

Market Size, Revenue (US$ Mn), Market CAGR (%), Market forecast (2023 - 2032)

1.3.2.

Global 3D Metrology Market

Revenue Share (%) and Growth Rate (Y-o-Y) from 2019 - 2033

1.4. Market

Segmentation

1.4.1.

Component of Global 3D Metrology

Market

1.4.2.

Application of Global 3D

Metrology Market

1.4.3.

Region of Global 3D Metrology

Market

2. Executive Summary

2.1. Global

3D Metrology Market Industry

Trends under COVID-19 Outbreak

2.1.1.

Global COVID-19 Status Overview

2.1.2.

Influence of COVID-19 Outbreak on

Global 3D Metrology Market

Industry Development

2.2. Market

Dynamics

2.2.1.

Drivers

2.2.2.

Limitations

2.2.3.

Opportunities

2.2.4.

Impact Analysis of Drivers and

Restraints

2.3. Pricing

Trends Analysis & Average Selling Prices (ASPs)

2.4. Key

Mergers & Acquisitions, Expansions, JVs, Funding / VCs, etc.

2.5. Porter’s

Five Forces Analysis

2.5.1.

Bargaining Power of Suppliers

2.5.2.

Bargaining Power of Buyers

2.5.3.

Threat of Substitutes

2.5.4.

Threat of New Entrants

2.5.5.

Competitive Rivalry

2.6. Value

Chain / Ecosystem Analysis

2.7. PEST

Analysis

2.8. Russia-Ukraine

War Impacts Analysis

2.9. Economic

Downturn Analysis

2.10.

Market Investment Opportunity

Analysis (Top Investment Pockets), By Segments & By Region

3. Global 3D Metrology Market Estimates &

Historical Trend Analysis (2020 - 2022)

4. Global 3D Metrology Market Estimates &

Forecast Trend Analysis, by

Component

4.1. Global

3D Metrology Market Revenue (US$ Mn) Estimates and Forecasts, by Component, 2022

to 2033

4.1.1.

Hardware

4.1.1.1.

Coordinate Measuring Machine

(CMM)

4.1.1.2.

Optical Digitizer & Scanner

(ODS)

4.1.1.3.

Video Measuring Machine (VMM)

4.1.1.4.

3D Automated Optical Inspection

(AOI) System

4.1.2.

Software

4.1.3.

Services

4.1.3.1.

Quality Control & Inspection

4.1.3.2.

Reverse Engineering

4.1.3.3.

Virtual Simulation

4.1.3.4.

3D Scanning

5. Global 3D Metrology Market Estimates &

Forecast Trend Analysis, by

Application

5.1. Global

3D Metrology Market Revenue (US$ Mn) Estimates and Forecasts, by Application, 2022

to 2033

5.1.1.

Aerospace

5.1.2.

Automotive

5.1.3.

Medical

5.1.4.

Construction & Engineering

5.1.5.

Heavy Machinery

5.1.6.

Others

6. Global 3D Metrology Market Estimates &

Forecast Trend Analysis,

by Region

6.1. Global

3D Metrology Market Revenue (US$ Mn) Estimates and Forecasts, by Region, 2022

to 2033

6.1.1.

North America

6.1.2.

Europe

6.1.3.

Asia Pacific

6.1.4.

Middle East & Africa

6.1.5.

South America

7. North

America 3D Metrology

Market: Estimates & Forecast Trend

Analysis

7.1. North

America 3D Metrology Market Assessments & Key Findings

7.1.1.

North America 3D Metrology Market

Introduction

7.1.2.

North America 3D Metrology Market

Size Estimates and Forecast (US$ Million) (2022 to 2033)

7.1.2.1.

By Component

7.1.2.2.

By Application

7.1.2.3.

By Voltage

7.1.2.4.

By End-user

7.1.2.5.

By Country

7.1.2.5.1.

The U.S.

7.1.2.5.2.

Canada

7.1.2.5.3.

Mexico

8. Europe

3D

Metrology Market: Estimates &

Forecast Trend Analysis

8.1. Europe

3D Metrology Market Assessments & Key Findings

8.1.1.

Europe 3D Metrology Market

Introduction

8.1.2.

Europe 3D Metrology Market Size

Estimates and Forecast (US$ Million) (2022 to 2033)

8.1.2.1.

By Component

8.1.2.2.

By Application

8.1.2.3.

By Country

8.1.2.3.1.

Germany

8.1.2.3.2.

U.K.

8.1.2.3.3.

France

8.1.2.3.4.

Italy

8.1.2.3.5.

Spain

8.1.2.3.6.

Russia

8.1.2.3.7.

Rest of Europe

9. Asia

Pacific 3D

Metrology Market: Estimates &

Forecast Trend Analysis

9.1. Asia

Pacific Market Assessments & Key Findings

9.1.1.

Asia Pacific 3D Metrology Market

Introduction

9.1.2.

Asia Pacific 3D Metrology Market

Size Estimates and Forecast (US$ Million) (2022 to 2033)

9.1.2.1.

By Component

9.1.2.2.

By Application

9.1.2.3.

By Country

9.1.2.3.1.

China

9.1.2.3.2.

Japan

9.1.2.3.3.

India

9.1.2.3.4.

Australia

9.1.2.3.5.

South Korea

9.1.2.3.6.

ASEAN

9.1.2.3.7.

Rest of Asia Pacific

10.

Middle East & Africa 3D Metrology Market: Estimates & Forecast Trend Analysis

10.1.

Middle East & Africa Market

Assessments & Key Findings

10.1.1.

Middle

East & Africa 3D Metrology Market Introduction

10.1.2.

Middle

East & Africa 3D Metrology Market Size Estimates and Forecast

(US$ Million) (2022 to 2033)

10.1.2.1.

By Component

10.1.2.2.

By Application

10.1.2.3.

By Country

10.1.2.3.1.

U.A.E.

10.1.2.3.2.

Saudi Arabia

10.1.2.3.3.

Egypt

10.1.2.3.4.

South Africa

10.1.2.3.5.

Rest of Middle East & Africa

11.

South America 3D Metrology Market: Estimates & Forecast Trend Analysis

11.1.

South America Market Assessments

& Key Findings

11.1.1.

South America 3D Metrology Market

Introduction

11.1.2.

South America 3D Metrology Market

Size Estimates and Forecast (US$ Million) (2022 to 2033)

11.1.2.1.

By Component

11.1.2.2.

By Application

11.1.2.3.

By Country

11.1.2.3.1.

Brazil

11.1.2.3.2.

Argentina

11.1.2.3.3.

Colombia

11.1.2.3.4.

Rest of South America

12.

Competition Landscape

12.1.

Global 3D Metrology Market

Competition Matrix & Benchmarking, by Leading Players / Innovators /

Emerging Players / New Entrants

12.2.

Global 3D Metrology Market

Concentration & Company Market Shares (%) Analysis, 2022

13.

Company Profiles

13.1.

Carl

Zeiss AG

13.1.1.

Company Overview & Key Stats

13.1.2.

Financial Performance & KPIs

13.1.3.

Product Portfolio

13.1.4.

Business Strategy & Recent

Developments

* Similar details would be provided for all the players

mentioned below

13.2.

Hexagon

AB

13.3.

FARO

Technologies

13.4.

Mitutoyo

Corporation

13.5.

Nikon

Corporation

13.6.

KLA-Tencor

13.7.

Keyence

Corporation

13.8.

Perceptron

13.9.

Creaform

13.10.

GOM mbH

13.11.

3D

Systems Corporation

13.12.

Others**

14.

Research

Methodology

14.1.

External Transportations /

Databases

14.2.

Internal Proprietary Database

14.3.

Primary Research

14.4.

Secondary Research

14.5.

Assumptions

14.6.

Limitations

14.7.

Report FAQs

15.

Research

Findings & Conclusion

Quality Assurance Process

- We Market Research’s Quality Assurance program strives to deliver superior value to our clients.

We Market Research senior executive is assigned to each consulting engagement and works closely with the project team to deliver as per the clients expectations.

Market Research Process

We Market Research monitors 3 important attributes during the QA process- Cost, Schedule & Quality. We believe them as a critical benchmark in achieving a project’s success.

To mitigate risks that can impact project success, we deploy the follow project delivery best practices:

- Project kickoff meeting with client

- Conduct frequent client communications

- Form project steering committee

- Assign a senior SR executive as QA Executive

- Conduct internal editorial & quality reviews of project deliverables

- Certify project staff in SR methodologies & standards

- Monitor client satisfaction

- Monitor realized value post-project

Case Study- Automotive Sector

One of the key manufacturers of automotive had plans to invest in electric utility vehicles. The electric cars and associated markets being a of evolving nature, the automotive client approached We Market Research for a detailed insight on the market forecasts. The client specifically asked for competitive analysis, regulatory framework, regional prospects studied under the influence of drivers, challenges, opportunities, and pricing in terms of revenue and sales (million units).

Solution

The overall study was executed in three stages, intending to help the client meet its objective of precisely understanding the entire market before deciding on an investment. At first, secondary research was conducted considering political, economic, social, and technological parameters to get a gist of the various aspects of the market. This stage of the study concluded with the derivation of drivers, opportunities, and challenges. It also laid substantial emphasis on understanding and collecting data not only on a global scale but also on the regional and country levels. Data Extraction through Primary Research

The second stage involved primary research in which several market players and automotive parts suppliers were contacted to study their viewpoint concerning the development of their market and production capacity, clientele, and product line. This stage concluded in a brief understanding of the competitive ecosystem and also glanced through the strategies and pricing of the companies profiled.

Market Estimates and Forecast

In the final stage of the study, market forecasts for the electric utility were derived using multiple market engineering approaches. This data helped the client to get an overview of the market and accelerate the process of investment.

Case Study- ICT Sector

Business process outsourcing, being one of the lucrative markets from both supply- and demand- side, has appealed to various companies. One of the prominent corporations based out of Japan approached us with their requirements regarding the scope of the procurement outsourcing market for around 50 countries. Additionally, the client also sought key players operating in the market and their revenue breakdown in terms of region and application.

Business Solution

An exhaustive market study was conducted based on primary and secondary research that involved factors such as labor costs in various countries, skilled and technical labors, manufacturing scenario, and their respective contributions in the global GDP. A comparative study of the market was conducted from both supply- and demand side, with the supply-side comprising of notable companies, such as GEP, Accenture, and others, that provide these services. On the other hand, large manufacturing companies from them demand-side were considered that opt for these services.

Conclusion

The report aided the client in understanding the market trends, including country-level business scenarios, consumer behavior, and trends in 50 countries. The report also provided financial insights of crucial players and detailed market estimations and forecasts till 2033.

}})

Select a license type that suits your business needs

US $3499

Only Three Thousand Four Hundred Ninety Nine US dollar

- 1 User access

- 15% Additional Free Customization

- Free Unlimited post-sale support

- 100% Service Guarantee until achievement of ROI

US $4499

Only Four Thousand Four Hundred Ninety Nine US dollar

- 5 Users access

- 25% Additional Free Customization

- Access Report summaries for Free

- Guaranteed service

- Dedicated Account Manager

- Discount of 20% on next purchase

- Get personalized market brief from Lead Author

- Printing of Report permitted

- Discount of 20% on next purchase

- 100% Service Guarantee until achievement of ROI

US $5499

Only Five Thousand Four Hundred Ninety Nine US dollar

- Unlimited User Access

- 30% Additional Free Customization

- Exclusive Previews to latest or upcoming reports

- Discount of 30% on next purchase

- 100% Service Guarantee until achievement of ROI