Exoskeleton Market Size and Forecast (2025 - 2035), Global and Regional Growth, Trend, Share and Industry Analysis Report Coverage: By Technology (Powered, Non-Powered), By Body Part (Lower Extremities, Upper Extremities, Full Body), By Mobility (Stationary, Mobile), By Structure (Rigid Exoskeletons, Soft Exoskeletons), By Vertical (Healthcare, Defense, Industrial, Others) And Geography.

- PUBLISHED ON

- 2025-04-25

- NO OF PAGES

- 281

- CATEGORY

- Healthcare & Life Sciences

Exoskeleton Market Overview

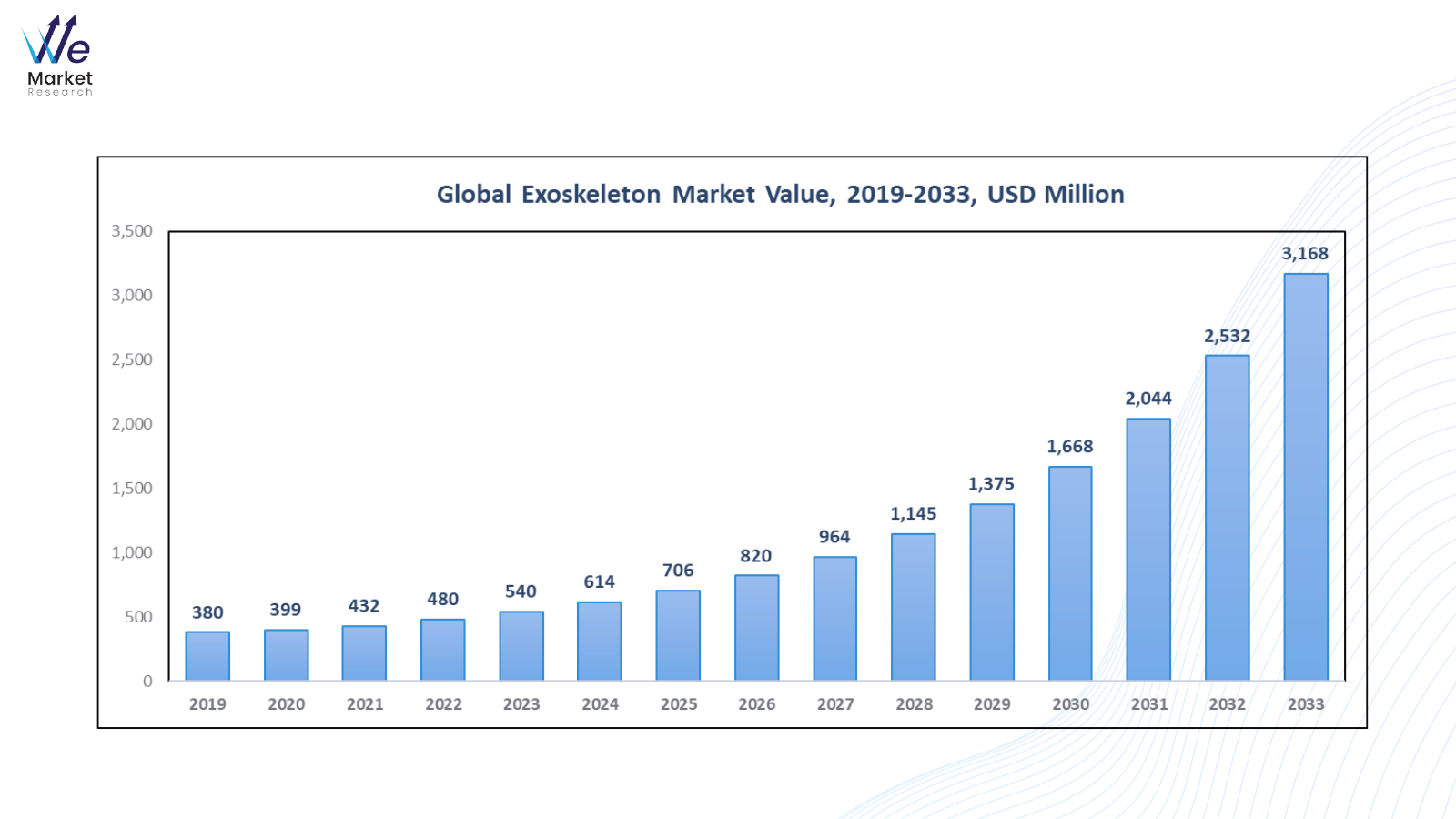

The exoskeleton market is anticipated to grow significantly from 2025 to 2035, driven by the rising demand for wearable robotic systems that enhance human mobility, strength, and endurance. By 2025, the market is projected to reach a value of around USD 4.9 Billion. Looking ahead to 2035, it is expected to expand further to about USD 13.2 Billion. This represents an annual growth rate of 15.8% over the ten-year period.

Exoskeletons, wearable external

structural frames, provide mechanical support and assistance to people with

physical impairment or for tasks that demand increased power. Based on market

analysis, the size of the global market for exoskeletons is projected to expand

strongly in the upcoming years on the back of technological innovation, rising

investments in robotics, and expanding awareness in various sectors like

healthcare, military, and industrial uses. The main reason propelling market

growth is the expanding incidence of physical disabilities and mobility-related

issues related to age. Exoskeletons are gaining acceptance in the health sector

to aid in the rehabilitation and mobility of people with spinal cord injuries,

strokes, or neurological conditions. In addition to this, an aging population

worldwide is generating immense demand for assistive devices and creating

significant opportunities for market growth in the future. In the industrial

sector, exoskeletons are being introduced to enhance the productivity of

workers and decrease wear and tear and injury, mainly in heavy-duty tasks like

manufacturing, construction, and logistics transportation. The military sector

is also generating strong demand with exoskeletons being designed to provide

increased stamina and decrease exertion and burden and provide strengthened load-carrying

capacity to soldiers.

Exoskeleton Market Drivers And Opportunities

The

Exoskeleton Market Is Expected to Grow in The Forecast Period with Rapid

Advances in Wearable Technology and Robots

Technological advancement ranks

among the most significant forces driving the growth of the exoskeleton market.

Advances in robotics, artificial intelligence (AI), machine learning (ML), and sensor technologies are driving the creation of lightweight, efficient, and highly

adaptive exoskeleton systems. Advances in these fields are making it possible

to engineer wearable

robots that not only support users' movements but also adapt and learn from

users' movement patterns in order to tailor support to fit individual needs.

Advances in integrating soft robotics and lightweight composite materials are

advancing ergonomics and user comfort, and these are paramount considerations

when it comes to consistent use in either clinical or industrial environments.

Cloud-connected platforms and IoT-enabled solutions provide real-time

monitoring, diagnostics, and optimization of performance to optimize function

and maximize safety. Advances in power density are also on the rise with more

efficient batteries allowing operation for several hours, particularly in

industrial uses. Synergistic convergence of these technologies is driving the

emergence of smart exoskeletons with the ability to extend human capabilities

in an array of application scenarios—from physical therapy to boosting stamina

among soldiers in the military. Continued R&D investment and more filed

patents mean the market is set to see an intensified rate of growth. These

innovations are vital to expanding commercial relevance and appeal among

exoskeleton systems globally.

Growing Demand in Industrial and Military Applications Is

a Vital Driver for Influencing the Growth of the Global Exoskeleton Market

Aside from healthcare, the need

for exoskeletons in industrial and military environments is accelerating with

tremendous growth rate and driving the market forward. In manufacturing,

logistics, and construction sectors, employees engage in repetitive work with

heavy lifting or unnatural posture leading to muscle strains, musculoskeletal

disorders, and work-related injuries. Exoskeletons offer mechanical assistance

and lower the load on the human body to make work more efficient, prevent

injuries, and increase workers' stamina. Organizations are more and more making

investments in wearable robotic exoskeletons to safeguard workers, cut

compensation outlays, and enhance productivity. Exoskeleton technology is being

explored by military forces worldwide to enhance soldiers' muscle power and

stamina too. Military defense institutions are making investments in R&D

projects to create powered suits to assist soldiers to carry heavy loads, cross

hard terrain, and avoid physical depletion during combat operations or rescue

missions. Nations like the United States, China, and Russia are leading the

pack in adopting such wearable solutions to their defense plans. As the need to

enforce stringent occupational protection rules increases and the drive to

modernize the military proliferates, demand for rugged, deployable exoskeleton

systems will surge exponentially—propelling defense and industrial segments to

become top revenue generators in the overall exoskeleton market globally.

Integration with Smart

Technologies and AI Is Poised to Create Significant Opportunities in The Global

Exoskeleton Market

The intersection of exoskeletons

with smart technologies like AI, IoT, and big data analytics offers the market

an opportunity to transform. Powerful AI algorithms have the ability to make

exoskeletons adjust dynamically to individuals' real-time movement patterns to

maximize effectiveness and user comfort. The personalization enhances therapy

and usability outcomes and improves performance in all industries. IoT

capabilities include enabling devices to interface with health systems, fitness

platforms, and industrial networks to provide remote monitoring, predictive

maintenance, and performance metrics. Such functions benefit particularly in

clinical environments in which physical therapy professionals remotely monitor

patient improvement and modify treatment procedures accordingly. In industrial

environments, productivity and ergonomics can be monitored in real time by

plant managers. Furthermore, the incorporation of augmented reality (AR) to

support guided operations and virtual reality (VR) to support rehabilitation

exercises opens up horizons in the arena of trainability and therapy. Not only

are these technological synergies making any exoskeleton smarter and more

intuitive, but they are also expanding its application base and industry reach.

As connected operations are made more interoperable and 5G penetration

increases, the full implications and promise of smart exoskeletons will emerge,

presenting firms with an opportunity to stand out with leading-edge,

data-supported solutions.

Exoskeleton Market Scope

|

Report

Attributes |

Description |

|

Market Size in 2025 |

USD 4.9 Billion |

|

Market

Forecast in 2035 |

USD 13.2

Billion |

|

CAGR % 2025-2035 |

15.8% |

|

Base

Year |

2024 |

|

Historic Data |

2020-2024 |

|

Forecast

Period |

2025-2035 |

|

Report USP

|

Production, Consumption, company

share, company heatmap, company production capacity, growth factors and more |

|

Segments

Covered |

|

|

Regional Scope |

|

|

Country

Scope |

|

Exoskeleton Market Report Segmentation Analysis

The Global Exoskeleton Market Industry

Analysis Is Segmented into By Technology, By Body Part, By Mobility, By

Structure, By Vertical And By Region.

The Powered Segment Is Anticipated to Hold the Highest Share of the

Global Exoskeleton Market During the Projected Timeframe.

Based on technology, market is segmented into powered and non-powered. The powered segment is the dominating segment with 73.2% of share in the world exoskeleton market due to its greater functionality and advanced supporting capabilities. Powered exoskeletons are powered by electric motors, hydraulics, or pneumatics to support or supplement user mobility and are particularly effective in the fields of clinical rehabilitation, industrial work, and defense missions.

The Lower Extremities Segment Is Anticipated To Hold The Highest Share

Of The Market Over The Forecast Period.

Based on body part, the market is

divided into lower extremities, upper extremities, and full-body exoskeletons.

In 2025, the lower extremities being the leading category in the exoskeleton

market globally. The reason behind the leading positioning is the strong demand

for mobility support and rehabilitation assistance among individuals with lower

extremity disability, spinal cord injury, and neurological conditions like

multiple sclerosis and stroke. Exoskeletons in the lower extremities are used

widely in medical and rehabilitation facilities to restore walking function and

enhance muscle exercise and balance in patients.

The Mobile Segment Dominated the Market in 2025 And Is Predicted to

Grow at The Highest CAGR Over the Forecast Period.

Based on mobility, the global

exoskeleton market is segmented into stationary and mobile systems. The mobile

system dominates the market share. Mobile exoskeletons are increasingly gaining

momentum based on increased user freedom and application level across markets

like healthcare, the military, and industrial environments. In contrast to

stationary systems, mobile exoskeletons enable the user to move freely and

naturally and can therefore be used effectively in physical therapy and on-site

assistance in harsh environments.

The Rigid Exoskeletons Segment Is

Predicted to Grow at The Highest CAGR Over the Forecast Period.

By structure market is segmented into rigid exoskeletons and soft exoskeletons, with rigid exoskeletons holding the dominant market share. Rigid exoskeletons are primarily favored for their superior strength, durability, and load-bearing capabilities, which make them highly effective in both medical rehabilitation and industrial support applications. The rising demand for injury prevention solutions and the growing number of rehabilitation cases worldwide are key driving factors for this segment.

The Healthcare Segment Is Expected to Dominate the Market During the

Forecast Period.

By vertical, market is segmented into

defense, industrial, healthcare, and others. The healthcare segment is emerging

as a dominating segment. The high demand for mobility aid and rehabilitation

solutions by neurological and muscular disorder-afflicted patients is driving

the exoskeletons' adoption on a mass level in the healthcare sector.

Exoskeletons are revolutionizing physical therapy with wearable robotic devices

that are assisting patients in recovering muscle function and mobility through

controlled movement and repetitive exercise.

The following segments are part of an in-depth analysis of the global exoskeleton

market:

|

Market

Segments |

|

|

By Technology |

|

|

By Body Part |

|

|

By Mobility |

|

|

By Structure |

|

|

By Vertical |

|

Exoskeleton Market Share Analysis By Region

Asia Pacific Is

Projected To Hold The Largest Share Of The Global Exoskeleton Market Over The

Forecast Period.

In 2025, Asia Pacific region emerging

as the dominating segment with 40.7% of market share. The area's dominance in

the exoskeleton market is mainly driven by the high rate of growth in robotics

technology, high-level investments by the government in the healthcare sector's

infrastructure, and the growing acceptance of rehabilitation robotics among

nations like Japan, China, and South Korea. Japan alone has been leading the

way in the development of robotic exoskeletons with widespread support from

public and private sectors to counter issues arising out of an aging population

and declining workforce. Furthermore, the aggressive Chinese drive to make way

for the development of medicine and automation within the industrial sector has

contributed to regional demand further. The area is also witnessing increased

acceptance of exoskeletons in elderly care, injury rehabilitation, and

industrial uses like logistics and manufacturing with the view to eliminating

physical strain and enhancing productivity among workers. Favorable regulatory

reforms and increased awareness of assistive technologies are creating an ideal

market for growth to take hold. Having efficient manufacturing capabilities

along with significant R&D investment in the area, the Asia Pacific region

will continue to dominate the world exoskeleton market through the forecast

period.

North America is forecasted to exhibit the highest CAGR through the forecast period through strong technological advancements in the region, with rising clinical trials and increased demand for exoskeletons in military and health care uses.

Exoskeleton Market Competition Landscape Analysis

The exoskeleton market features

intense competition, with a mix of established leaders and innovative newcomers

vying for market share. Industry pioneers like Ekso Bionics, SuitX, ReWalk

Robotics, and Cyberdyne currently dominate the space, while emerging contenders

such as Rex Bionics, RB3D, and Lockheed Martin are rapidly gaining traction

with cutting-edge solutions. This dynamic competitive landscape reflects the

sector's growth potential as technological advancements continue to accelerate

market expansion.

Global Exoskeleton

Market Recent Developments News:

In December 2023, German Bionic

has unveiled its Apogee robotic exoskeleton, an advanced assistive technology

designed specifically for healthcare professionals. The innovative system

combines AI-powered robotic motors with ergonomic design.

In December 2022, Ekso announced

the acquisition of Parker Hannifin Corporation's Human Motion and Control

business unit. The deal includes the Indego lower limb exoskeleton product line

and the future development of robotic-assisted prosthetic and orthotic

products. The complementary acquisition enhances Ekso's product offerings along

the continuum of patient care to home and community use markets expand Ekso's

pipeline and introduce strategic collaborations with major commercial and

research partners, including Vanderbilt University.

In June 2022, CYBERDYNE Inc. has

entered into a business and capital alliance with LIFESCAPES Inc., marking a

significant step forward in next-generation rehabilitation solutions for

patients with severe paralysis.

The Global Exoskeleton Market

is dominated by a few large companies, such as

·

Bionik Laboratories

·

Cyberdyne Inc.

·

Ekso Bionics Holdings, Inc.

·

Hocoma AG

·

Honda Motor Co., Ltd.

·

Lockheed Martin Corporation

·

Ottobock

·

Parker Hannifin Corp.

·

Rewalk Robotics Ltd.

·

Rex Bionics Ltd.

·

Sarcos Technology and Robotics Corporation

·

Technaid S.L.

·

Wandercraft

·

Wearable Robotics srl

·

Willow Wood

·

Others

1.

Global

Exoskeleton Market Introduction and Market Overview

1.1. Objectives of the Study

1.2. Global Exoskeleton Market Scope

and Market Estimation

1.2.1. Global Exoskeleton Overall

Market Size (US$ Bn), Market CAGR (%), Market forecast (2025 - 2035)

1.2.2. Global Exoskeleton Market

Revenue Share (%) and Growth Rate (Y-o-Y) from 2021 - 2035

1.3. Market Segmentation

1.3.1. Technology of Global Exoskeleton

Market

1.3.2. Body Part of Global Exoskeleton

Market

1.3.3. Mobility of Global Exoskeleton

Market

1.3.4. Structure of Global Exoskeleton

Market

1.3.5. Vertical of Global Exoskeleton

Market

1.3.6. Region of Global Exoskeleton

Market

2.

Executive Summary

2.1. Demand Side Trends

2.2. Key Market Trends

2.3. Market Demand (US$ Bn) Analysis

2021 – 2024 and Forecast, 2025 – 2035

2.4. Demand and Opportunity Assessment

2.5. Demand Supply Scenario

2.6. Market Dynamics

2.6.1. Drivers

2.6.2. Limitations

2.6.3. Opportunities

2.6.4. Impact Analysis of Drivers and

Restraints

2.7. Pricing Trends Analysis

2.8. Overview of Technology Developments

2.9. Porter’s Five Forces Analysis

2.9.1. Bargaining Power of Suppliers

2.9.2. Bargaining Power of Buyers

2.9.3. Threat of Substitutes

2.9.4. Threat of New Entrants

2.9.5. Competitive Rivalry

2.10. PEST Analysis

2.10.1. Political Factors

2.10.2. Economic Factors

2.10.3. Social Factors

2.10.4. Technology Factors

2.11. Value Chain / Ecosystem Analysis

2.12. Key Regulation

3.

Global Exoskeleton Market Estimates & Historical Trend Analysis (2021 - 2024)

4.

Global Exoskeleton Market Estimates & Forecast Trend Analysis, by

Technology

4.1. Global Exoskeleton Market

Revenue (US$ Bn) Estimates and Forecasts, by Technology, 2021 - 2035

4.1.1. Powered

4.1.2. Non-powered

5.

Global Exoskeleton Market Estimates & Forecast Trend Analysis, by

Body Part

5.1. Global Exoskeleton Market

Revenue (US$ Bn) Estimates and Forecasts, by Body Part, 2021 - 2035

5.1.1. Lower Extremities

5.1.2. Upper Extremities

5.1.3. Full Body

6.

Global Exoskeleton Market Estimates & Forecast Trend Analysis, by

Mobility

6.1. Global Exoskeleton Market

Revenue (US$ Bn) Estimates and Forecasts, by Mobility, 2021 - 2035

6.1.1. Stationary

6.1.2. Mobile

7.

Global Exoskeleton Market Estimates & Forecast Trend Analysis, by

Structure

7.1. Global Exoskeleton Market

Revenue (US$ Bn) Estimates and Forecasts, by Structure, 2021 - 2035

7.1.1. Rigid Exoskeletons

7.1.2. Soft Exoskeletons

8.

Global Exoskeleton Market Estimates & Forecast Trend Analysis, by

Vertical

8.1. Global Exoskeleton Market

Revenue (US$ Bn) Estimates and Forecasts, by Vertical, 2021 - 2035

8.1.1. Healthcare

8.1.2. Defense

8.1.3. Industrial

8.1.4. Others

9.

Global Exoskeleton Market Estimates & Forecast Trend Analysis,

by Region

9.1. Global Exoskeleton Market

Revenue (US$ Bn) Estimates and Forecasts, by Region, 2021 - 2035

9.1.1. North America

9.1.2. Eastern Europe

9.1.3. Western Europe

9.1.4. Asia Pacific

9.1.5. Middle East & Africa

9.1.6. Latin America

10. North America Exoskeleton

Market: Estimates & Forecast Trend

Analysis

10.1.

North

America Exoskeleton Market Assessments & Key Findings

10.1.1. North America Exoskeleton Market

Introduction

10.1.2. North America Exoskeleton Market

Size Estimates and Forecast (US$ Billion) (2021 - 2035)

10.1.2.1. By Technology

10.1.2.2. By Body Part

10.1.2.3. By Mobility

10.1.2.4. By Structure

10.1.2.5. By Vertical

10.1.2.6. By Country

10.1.2.6.1. The U.S.

10.1.2.6.2. Canada

10.1.2.6.3. Mexico

11. Western Europe Exoskeleton

Market: Estimates & Forecast Trend

Analysis

11.1. Western Europe Exoskeleton

Market Assessments & Key Findings

11.1.1. Western Europe Exoskeleton

Market Introduction

11.1.2. Western Europe Exoskeleton

Market Size Estimates and Forecast (US$ Billion) (2021 - 2035)

11.1.2.1. By Technology

11.1.2.2. By Body Part

11.1.2.3. By Mobility

11.1.2.4. By Structure

11.1.2.5. By Vertical

11.1.2.6. By Country

11.1.2.6.1.

Germany

11.1.2.6.2.

Italy

11.1.2.6.3.

U.K.

11.1.2.6.4.

France

11.1.2.6.5.

Spain

11.1.2.6.6.

Benelux

11.1.2.6.7.

Nordics

11.1.2.6.8. Rest

of W. Europe

12. Eastern Europe Exoskeleton

Market: Estimates & Forecast Trend

Analysis

12.1. Eastern Europe Exoskeleton

Market Assessments & Key Findings

12.1.1. Eastern Europe Exoskeleton

Market Introduction

12.1.2. Eastern Europe Exoskeleton

Market Size Estimates and Forecast (US$ Billion) (2021 - 2035)

12.1.2.1. By Technology

12.1.2.2. By Body Part

12.1.2.3. By Mobility

12.1.2.4. By Structure

12.1.2.5. By Vertical

12.1.2.6. By Country

12.1.2.6.1.

Russia

12.1.2.6.2.

Hungary

12.1.2.6.3.

Poland

12.1.2.6.4.

Balkan & Baltics

12.1.2.6.5. Rest of E. Europe

13. Asia Pacific Exoskeleton

Market: Estimates & Forecast Trend

Analysis

13.1. Asia Pacific Market Assessments

& Key Findings

13.1.1. Asia Pacific Exoskeleton Market

Introduction

13.1.2. Asia Pacific Exoskeleton Market

Size Estimates and Forecast (US$ Billion) (2021 - 2035)

13.1.2.1. By Technology

13.1.2.2. By Body Part

13.1.2.3. By Mobility

13.1.2.4. By Structure

13.1.2.5. By Vertical

13.1.2.6. By Country

13.1.2.6.1. China

13.1.2.6.2. Japan

13.1.2.6.3. India

13.1.2.6.4. Australia & New Zealand

13.1.2.6.5. South Korea

13.1.2.6.6. ASEAN

13.1.2.6.7. Rest of Asia Pacific

14. Middle East & Africa Exoskeleton

Market: Estimates & Forecast Trend

Analysis

14.1. Middle East & Africa Market

Assessments & Key Findings

14.1.1. Middle

East & Africa Exoskeleton

Market Introduction

14.1.2. Middle

East & Africa Exoskeleton

Market Size Estimates and Forecast (US$ Billion) (2021 - 2035)

14.1.2.1. By Technology

14.1.2.2. By Body Part

14.1.2.3. By Mobility

14.1.2.4. By Structure

14.1.2.5. By Vertical

14.1.2.6. By Country

14.1.2.6.1. UAE

14.1.2.6.2. Saudi

Arabia

14.1.2.6.3. Turkey

14.1.2.6.4. South

Africa

14.1.2.6.5. Rest of

MEA

15. Latin America

Exoskeleton Market: Estimates &

Forecast Trend Analysis

15.1. Latin America Market Assessments

& Key Findings

15.1.1. Latin America Exoskeleton Market

Introduction

15.1.2. Latin America Exoskeleton Market

Size Estimates and Forecast (US$ Billion) (2021 - 2035)

15.1.2.1. By Technology

15.1.2.2. By Body Part

15.1.2.3. By Mobility

15.1.2.4. By Structure

15.1.2.5. By Vertical

15.1.2.6. By Country

15.1.2.6.1. Brazil

15.1.2.6.2. Argentina

15.1.2.6.3. Colombia

15.1.2.6.4. Rest of

LATAM

16. Country Wise Market:

Introduction

17. Competition Landscape

17.1. Global Exoskeleton Market Product

Mapping

17.2. Global Exoskeleton Market

Concentration Analysis, by Leading Players / Innovators / Emerging Players /

New Entrants

17.3. Global Exoskeleton Market Tier

Structure Analysis

17.4. Global Exoskeleton Market

Concentration & Company Market Shares (%) Analysis, 2023

18. Company Profiles

18.1. Bionik Laboratories

18.1.1. Company Overview & Key Stats

18.1.2. Financial Performance & KPIs

18.1.3. Product Portfolio

18.1.4. SWOT Analysis

18.1.5. Business Strategy & Recent

Developments

* Similar details would be provided

for all the players mentioned below

18.2. Cyberdyne Inc.

18.3. Ekso Bionics

Holdings, Inc.

18.4. Hocoma AG

18.5. Honda Motor Co.,

Ltd.

18.6. Lockheed Martin

Corporation

18.7. Ottobock

18.8. Parker Hannifin

Corp.

18.9. Rewalk Robotics

Ltd.

18.10. Rex Bionics Ltd.

18.11. Sarcos Technology

and Robotics Corporation

18.12. Technaid S.L.

18.13. Wandercraft

18.14. Wearable Robotics

srl

18.15. Willow Wood

18.16. Others

19. Research

Methodology

19.1. External Transportations /

Databases

19.2. Internal Proprietary Database

19.3. Primary Research

19.4. Secondary Research

19.5. Assumptions

19.6. Limitations

19.7. Report FAQs

20. Research Findings & Conclusion

Quality Assurance Process

- We Market Research’s Quality Assurance program strives to deliver superior value to our clients.

We Market Research senior executive is assigned to each consulting engagement and works closely with the project team to deliver as per the clients expectations.

Market Research Process

We Market Research monitors 3 important attributes during the QA process- Cost, Schedule & Quality. We believe them as a critical benchmark in achieving a project’s success.

To mitigate risks that can impact project success, we deploy the follow project delivery best practices:

- Project kickoff meeting with client

- Conduct frequent client communications

- Form project steering committee

- Assign a senior SR executive as QA Executive

- Conduct internal editorial & quality reviews of project deliverables

- Certify project staff in SR methodologies & standards

- Monitor client satisfaction

- Monitor realized value post-project

Case Study- Automotive Sector

One of the key manufacturers of automotive had plans to invest in electric utility vehicles. The electric cars and associated markets being a of evolving nature, the automotive client approached We Market Research for a detailed insight on the market forecasts. The client specifically asked for competitive analysis, regulatory framework, regional prospects studied under the influence of drivers, challenges, opportunities, and pricing in terms of revenue and sales (million units).

Solution

The overall study was executed in three stages, intending to help the client meet its objective of precisely understanding the entire market before deciding on an investment. At first, secondary research was conducted considering political, economic, social, and technological parameters to get a gist of the various aspects of the market. This stage of the study concluded with the derivation of drivers, opportunities, and challenges. It also laid substantial emphasis on understanding and collecting data not only on a global scale but also on the regional and country levels. Data Extraction through Primary Research

The second stage involved primary research in which several market players and automotive parts suppliers were contacted to study their viewpoint concerning the development of their market and production capacity, clientele, and product line. This stage concluded in a brief understanding of the competitive ecosystem and also glanced through the strategies and pricing of the companies profiled.

Market Estimates and Forecast

In the final stage of the study, market forecasts for the electric utility were derived using multiple market engineering approaches. This data helped the client to get an overview of the market and accelerate the process of investment.

Case Study- ICT Sector

Business process outsourcing, being one of the lucrative markets from both supply- and demand- side, has appealed to various companies. One of the prominent corporations based out of Japan approached us with their requirements regarding the scope of the procurement outsourcing market for around 50 countries. Additionally, the client also sought key players operating in the market and their revenue breakdown in terms of region and application.

Business Solution

An exhaustive market study was conducted based on primary and secondary research that involved factors such as labor costs in various countries, skilled and technical labors, manufacturing scenario, and their respective contributions in the global GDP. A comparative study of the market was conducted from both supply- and demand side, with the supply-side comprising of notable companies, such as GEP, Accenture, and others, that provide these services. On the other hand, large manufacturing companies from them demand-side were considered that opt for these services.

Conclusion

The report aided the client in understanding the market trends, including country-level business scenarios, consumer behavior, and trends in 50 countries. The report also provided financial insights of crucial players and detailed market estimations and forecasts till 2033.

Frequently Asked Questions

What is the market size of Exoskeleton Market in 2025?

Exoskeleton Market was valued at USD 4.9 Billion in 2025.

What is the growth rate for the Exoskeleton Market?

Exoskeleton Market size will increase at approximate CAGR of 15.8% during the forecasted period.

Which are the top companies operating within the market?

Major companies operating within the market are Ekso Bionics, SuitX, ReWalk Robotics, and Cyberdyne and others.

Which region dominates the Exoskeleton Market?

Asia Pasific dominates the market with an active share of 40.7%.

}})

Select a license type that suits your business needs

US $3499

Only Three Thousand Four Hundred Ninety Nine US dollar

- 1 User access

- 15% Additional Free Customization

- Free Unlimited post-sale support

- 100% Service Guarantee until achievement of ROI

US $4499

Only Four Thousand Four Hundred Ninety Nine US dollar

- 5 Users access

- 25% Additional Free Customization

- Access Report summaries for Free

- Guaranteed service

- Dedicated Account Manager

- Discount of 20% on next purchase

- Get personalized market brief from Lead Author

- Printing of Report permitted

- Discount of 20% on next purchase

- 100% Service Guarantee until achievement of ROI

US $5499

Only Five Thousand Four Hundred Ninety Nine US dollar

- Unlimited User Access

- 30% Additional Free Customization

- Exclusive Previews to latest or upcoming reports

- Discount of 30% on next purchase

- 100% Service Guarantee until achievement of ROI