Electric Vehicle Adhesives Market Analysis by Vehicle (Plug in hybrid electric vehicle, Battery electric vehicle), By Application, By Resin, By Substrate, By Form, By End User and by Region: Global Forecast, 2024 - 2033

- PUBLISHED ON

- 2024-06-03

- NO OF PAGES

- 291

- CATEGORY

- Chemicals & Materials

Market Overview

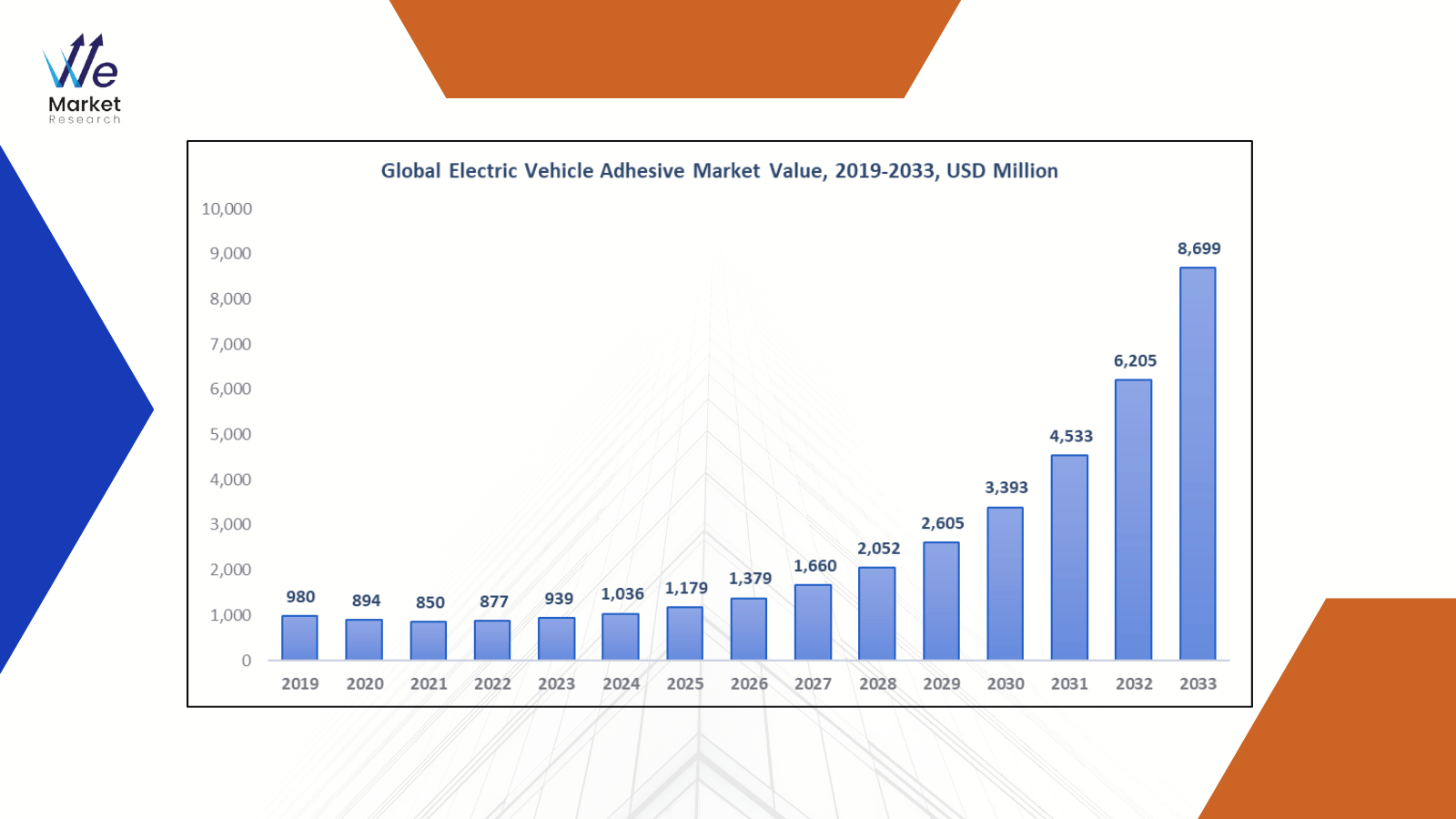

The Electric Vehicle Adhesives market is

predicted to develop at a compound annual growth rate (CAGR) of 20.62% from

2024 to 2033, when it is projected to reach USD 12.52 billion, based on an

average growth pattern. The market is estimated to reach a value of USD 2.46 billion

in 2024.

SOURCE: We Market Research

Electric vehicle adhesives refer to specialized bonding materials used in the assembly of components and structures within electric vehicles (EVs). These adhesives are designed to provide strong, durable bonds between various materials such as metals, plastics, and composites, ensuring the integrity and longevity of the vehicle's construction. They play a crucial role in enhancing structural stability, reducing weight, and improving overall vehicle performance while also contributing to the efficiency and sustainability goals of electric mobility. These adhesives are formulated to withstand the unique challenges faced by EVs, including exposure to high temperatures, vibrations, and potential chemical interactions with battery components.

In the electric vehicle adhesives market, several key trends are emerging. One significant trend is the increased adoption of lightweight materials in electric vehicle construction, such as composites and aluminum, to improve energy efficiency and range. This shift necessitates specialized adhesives that can effectively bond these materials while maintaining structural integrity. Additionally, the growing demand for battery electric vehicles (BEVs) is driving the need for adhesives tailored to battery assembly and housing, requiring strong bonds capable of withstanding high temperatures and chemical exposure. Another trend is the emphasis on sustainability, with manufacturers seeking eco-friendly adhesives with reduced VOC emissions and environmental impact. Innovations in adhesive technologies are also prevalent, with advancements in formulations and application methods improving performance and reliability. Moreover, there is a focus on enhancing safety and durability, leading to the development of adhesives meeting stringent standards for critical component integrity. As the industry shifts towards autonomous and connected vehicles, adhesives are evolving to bond advanced sensor systems and electronics seamlessly into vehicle structures. Overall, the electric vehicle adhesives market is characterized by continuous innovation to support the rapid growth of electric mobility while meeting increasingly stringent performance, sustainability, and safety requirements.

Market Scope

|

Report Attributes |

Description |

|

Market Size in 2024 |

USD 2.46 Billion |

|

Market Forecast in 2033 |

USD 12.52 Billion |

|

CAGR % 2024-2033 |

20.62% |

|

Base Year |

2023 |

|

Historic Data |

2016-2022 |

|

Forecast Period |

2024-2033 |

|

Report USP

|

Production, Consumption, company share, company

heatmap, company production capacity, growth factors and more |

|

Segments Covered |

By Vehicle ,By Application, By Resin, By Substrate, By Form, By

End User and By Region |

|

Regional Scope |

North America, Europe, APAC, South America and

Middle East and Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Benelux; Nordic

Countries; Russia; China; India; Japan; South Korea; Australia; Indonesia;

Thailand; Mexico; Brazil; Argentina; Saudi Arabia; UAE; Egypt; South Africa;

Nigeria |

Electric Vehicle Adhesives Industry: Dynamics &

Restrains

Market Drivers

Rising Demand

for Electric Vehicles - Electric vehicle

adhesives market growth is being driven by the increasing demand for electric

vehicles (EVs). The need for improved adhesive solutions is being driven by the

increasing popularity of electric vehicles (EVs) in the automotive industry,

which is undergoing a large change towards sustainability. The structural

integrity, lightweight design, and general performance of electric vehicle (EV)

components are all improved by the use of adhesives. Electronic systems,

battery packs, and other essential components are assembled more effectively

thanks to these adhesives. Reflecting the critical role adhesives play in

supporting the growing electric car market, manufacturers are increasingly

depending on specialist adhesives to meet strict performance and safety

criteria.

Increased Focus

on Battery Technology - A major factor

propelling the expansion of the electric vehicle adhesives market is the

increased focus on battery technology. Modern battery systems are at the

forefront of innovation as automobile electrification becomes more and more

common. In order to secure and maximize the performance of complex battery

components, electric vehicle adhesives are essential. Specialized adhesives

made to survive harsh circumstances are becoming more and more in demand as

manufacturers concentrate on improving the energy density, durability, and

safety of batteries for electric vehicles. Adhesives play a crucial part in

improving battery technology for electric vehicles by aiding in the effective

bonding of battery cells, guaranteeing their dependability and durability.

Market restrains

Technical

Challenges in Battery Assembly - The electric

vehicle adhesives market is limited by technical issues with battery assembly.

The complicated shapes and diverse materials of electric vehicle batteries pose

hurdles for adhesive applications. Adhesive technologies need to solve

challenges such as ensuring stable and dependable bonding on a variety of

substrates, responding to temperature variations, and handling thermal

expansion problems. Manufacturers are faced with the challenge of creating adhesives

that can meet the increasing demand for high-performance batteries, which makes

it more difficult to integrate these solutions seamlessly into the changing

environment of electric vehicle battery assembly. For electric vehicle

adhesives to be widely used, it is imperative that these technological issues

are resolved.

We Market

Research: Electric Vehicle Adhesives

Dashboard

Our marketing platform offers a comprehensive dashboard that provides clients with valuable insights into market trends over the years. Included below is a sample image of our dashboard, and specific PDF logins will be furnished to grant access to this insightful tool.

Electric Vehicle Adhesives Segmentation

Market- By Vehicle Analysis

By Vehicle, the Electric Vehicle Adhesives Market is Categories into Plug in hybrid electric vehicle, Battery electric vehicle. The Plug in hybrid electric vehicle segment accounts for the largest share of around 56% in 2024.

Plug-in Hybrid Electric Vehicles (PHEVs)

have gained popularity because of its dual-power mechanism, which makes it

simple for them to switch between combustion and electric engines. This

addresses range concerns, attracts eco-conscious consumers, and offers a

practical choice for individuals transitioning to electric cars.

The

following segments are part of an in-depth analysis of the global Electric

Vehicle Adhesives market:

|

Market Segments |

|

|

By Application |

·

Interior ·

Exterior ·

Powertrain |

|

By Resin |

·

Silicon ·

Polyurethane ·

Epoxy ·

Acrylics ·

Others |

|

By Substrate |

·

Composite ·

Plastic ·

Metals ·

Others |

|

By Form |

·

Liquid ·

Film & Tape ·

Others |

|

By End User |

·

Pack & module bonding ·

Thermal interface bonding ·

Battery cell encapsulation ·

Others |

Electric Vehicle Adhesives Industry: Regional Analysis

Asia Pacific Market Forecast

Asia Pacific dominate the Electric Vehicle Adhesives Market with the highest revenue generating market with share of more than 46%. The Asia-Pacific region's increasing adoption of electric cars, particularly in China, has created a need for novel adhesives that guarantee structural integrity and safety in EV manufacturing. The favorable regulations and incentives from the government are contributing to the expansion of the electric vehicle adhesive market, which is in line with the region's commitment to environmentally friendly transportation solutions.

North America Market Statistics

North America is

the second-largest market for Electric Vehicle Adhesives. Strong environmental

restrictions in North America are driving up demand for electric vehicles

(EVs), which in turn is driving up demand for specialty adhesives. The market

is further propelled by ongoing technological developments in EVs and

encouraging government subsidies, which encourage consumers to select

eco-friendly solutions and increase the region's overall adoption of EV

adhesives.

Europe Market Forecasts

Europe is expected

to be the fastest-growing market for Electric Vehicle Adhesives during the

forecast period. Europe's aggressive pollution reduction targets encourage the

use of electric vehicles, which calls for the use of specialty adhesives to

improve energy efficiency and light weighting. The need for cutting-edge

adhesives that improve the efficiency and security of electric vehicles is

being driven by rising government and private sector investments in the

infrastructure supporting electric mobility.

Key Market Players

The Electric

Vehicle Adhesives Market is dominated by a few large companies, such as

·

Sika AG (Switzerland)

·

Ashland (US)

·

H.B. Fuller (US)

·

Permabond (UK)

·

3M (US)

·

L&L Products (US)

·

Jowat SE (Germany)

·

PPG Industries (US)

·

Henkel (Germany),

·

Wacker Chemie AG (Germany)

·

Bostik SA – An Arkema company

(France)

·

Others

Recent Developments:

·

September 2022, The Thermal

Management Materials division of Nanoramic Laboratories has been fully acquired

by Henkel AG & Co. KGaA. By enhancing its capabilities in high-performance

categories, Henkel leveraged this acquisition to boost the position of its

Adhesive Technologies business unit in the expanding markets for Thermal

Interface Materials (TIM).

·

January 2022, The largest

independent producer of liquid adhesives, coatings, and primers in the UK for

the roofing, industrial, and construction markets, Apollo was acquired by H.B.

Fuller Company, it was reported.

1.

Global

Electric Vehicle Adhesives Market Introduction and Market Overview

1.1. Objectives of the Study

1.2. Global Electric Vehicle

Adhesives Market Scope and Market Estimation

1.2.1. Global Electric Vehicle

Adhesives Overall Market Size, Revenue (US$ Mn), Market CAGR (%), Market

forecast (2023 - 2033)

1.2.2. Global Electric Vehicle

Adhesives Market Revenue Share (%) and Growth Rate (Y-o-Y) from 2019 - 2033

1.3. Market Segmentation

1.3.1. Component of Global Electric

Vehicle Adhesives Market

1.3.2. Technology of Global Electric

Vehicle Adhesives Market

1.3.3. Resin of Global Electric Vehicle

Adhesives Market

1.3.4. Region of Global Electric

Vehicle Adhesives Market

2.

Executive Summary

2.1. Global Electric Vehicle Adhesives Market Industry Trends under COVID-19 Outbreak

2.1.1. Global COVID-19 Status Overview

2.1.2. Influence of COVID-19 Outbreak

on Global Electric Vehicle Adhesives Market

Industry Development

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Limitations

2.2.3. Opportunities

2.2.4. Impact Analysis of Drivers and

Restraints

2.3. Pricing Trends Analysis & Average

Selling Prices (ASPs)

2.4. Key Mergers & Acquisitions,

Expansions, JVs, Funding / VCs, etc.

2.5. Porter’s Five Forces Analysis

2.5.1. Bargaining Power of Suppliers

2.5.2. Bargaining Power of Buyers

2.5.3. Threat of Substitutes

2.5.4. Threat of New Entrants

2.5.5. Competitive Rivalry

2.6. Value Chain / Ecosystem Analysis

2.7. Russia-Ukraine War Impacts

Analysis

2.8. Economic Downturn Analysis

2.9. Market Investment Opportunity

Analysis (Top Investment Pockets), By Segments & By Region

3.

Global Electric Vehicle

Adhesives Market Estimates &

Historical Trend Analysis (2019 - 2022)

4.

Global Electric Vehicle

Adhesives Market Estimates &

Forecast Trend Analysis, by VEHICLE

4.1. Global Electric Vehicle

Adhesives Market Revenue (US$ Mn) Estimates and Forecasts, by VEHICLE, 2019 to 2033

4.1.1. Plug in hybrid electric vehicle

4.1.2. Battery electric vehicle

5.

Global Electric Vehicle

Adhesives Market Estimates &

Forecast Trend Analysis, by Application

5.1. Global Electric Vehicle

Adhesives Market Revenue (US$ Mn) Estimates and Forecasts, by Application, 2019

to 2033

5.1.1. Interior

5.1.2. Exterior

5.1.3. Powertrain

6.

Global Electric Vehicle

Adhesives Market Estimates &

Forecast Trend Analysis, by Resin

6.1. Global Electric Vehicle

Adhesives Market Revenue (US$ Mn) Estimates and Forecasts, by Resin, 2019 to 2033

6.1.1. Silicon

6.1.2. Polyurethane

6.1.3. Epoxy

6.1.4. Acrylics

6.1.5. Others

7.

Global Electric Vehicle

Adhesives Market Estimates &

Forecast Trend Analysis, by SUBSTRATE

7.1. Global Electric Vehicle

Adhesives Market Revenue (US$ Mn) Estimates and Forecasts, by Resin, 2019 to 2033

7.1.1. Composite

7.1.2. Plastic

7.1.3. Metals

7.1.4. Others

8.

Global Electric Vehicle

Adhesives Market Estimates &

Forecast Trend Analysis, by FORM

8.1. Global Electric Vehicle

Adhesives Market Revenue (US$ Mn) Estimates and Forecasts, by Resin, 2019 to 2033

8.1.1. Liquid

8.1.2. Film & Tape

8.1.3. Others

9.

Global Electric Vehicle

Adhesives Market Estimates &

Forecast Trend Analysis, by END USER

9.1. Global Electric Vehicle

Adhesives Market Revenue (US$ Mn) Estimates and Forecasts, by Resin, 2019 to 2033

9.1.1. Pack & module bonding

9.1.2. Thermal interface bonding

9.1.3. Battery cell encapsulation

9.1.4. Others

10. Global

Electric Vehicle Adhesives Market

Estimates & Forecast Trend Analysis, by Region

10.1.

Global

Electric Vehicle Adhesives Market Revenue (US$ Mn) Estimates and Forecasts, by Region,

2019 to 2033

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

11. North America Electric

Vehicle Adhesives Market: Estimates

& Forecast Trend Analysis

11.1.

North

America Electric Vehicle Adhesives Market Assessments & Key Findings

11.1.1. North America Electric Vehicle

Adhesives Market Introduction

11.1.2. North America Electric Vehicle

Adhesives Market Size Estimates and Forecast (US$ Million) (2019 – 2033)

11.1.2.1. By VEHICLE

11.1.2.2. By Application

11.1.2.3. By Resin

11.1.2.4. By SUBSTRATE

11.1.2.5. By FORM

11.1.2.6. By END USER

11.1.2.7. By Country

11.1.2.7.1. The U.S.

11.1.2.7.2. Canada

11.1.2.7.3. Mexico

12. Europe Electric

Vehicle Adhesives Market: Estimates

& Forecast Trend Analysis

12.1. Europe Electric Vehicle

Adhesives Market Assessments & Key Findings

12.1.1. Europe Electric Vehicle

Adhesives Market Introduction

12.1.2. Europe Electric Vehicle

Adhesives Market Size Estimates and Forecast (US$ Million) (2019 – 2033)

12.1.2.1. By VEHICLE

12.1.2.2. By Application

12.1.2.3. By Resin

12.1.2.4. By SUBSTRATE

12.1.2.5. By FORM

12.1.2.6. By END USER

12.1.2.7. By Country

12.1.2.7.1. Germany

12.1.2.7.2. U.K.

12.1.2.7.3. France

12.1.2.7.4. Italy

12.1.2.7.5. Spain

12.1.2.7.6. Russia

12.1.2.7.7. Rest of Europe

13. Asia Pacific Electric

Vehicle Adhesives Market: Estimates

& Forecast Trend Analysis

13.1. Asia Pacific Market Assessments

& Key Findings

13.1.1. Asia Pacific Electric Vehicle Adhesives

Market Introduction

13.1.2. Asia Pacific Electric Vehicle

Adhesives Market Size Estimates and Forecast (US$ Million) (2019 – 2033)

13.1.2.1. By VEHICLE

13.1.2.2. By Application

13.1.2.3. By Resin

13.1.2.4. By SUBSTRATE

13.1.2.5. By FORM

13.1.2.6. By END USER

13.1.2.7. By Country

13.1.2.7.1. China

13.1.2.7.2. Japan

13.1.2.7.3. India

13.1.2.7.4. Australia

13.1.2.7.5. South Korea

13.1.2.7.6. ASEAN

13.1.2.7.7. Rest of Asia Pacific

14. Middle East & Africa Electric

Vehicle Adhesives Market: Estimates

& Forecast Trend Analysis

14.1. Middle East & Africa Market

Assessments & Key Findings

14.1.1. Middle

East & Africa Electric

Vehicle Adhesives Market Introduction

14.1.2. Middle

East & Africa Electric

Vehicle Adhesives Market Size Estimates and Forecast (US$ Million) (2019 – 2033)

14.1.2.1. By VEHICLE

14.1.2.2. By Application

14.1.2.3. By Resin

14.1.2.4. By SUBSTRATE

14.1.2.5. By FORM

14.1.2.6. By END USER

14.1.2.7. By Country

14.1.2.7.1. U.A.E.

14.1.2.7.2. Saudi Arabia

14.1.2.7.3. Egypt

14.1.2.7.4. South Africa

14.1.2.7.5. Rest of Middle East & Africa

15. South America

Electric Vehicle Adhesives Market:

Estimates & Forecast Trend Analysis

15.1. South America Market Assessments

& Key Findings

15.1.1. South America Electric Vehicle

Adhesives Market Introduction

15.1.2. South America Electric Vehicle

Adhesives Market Size Estimates and Forecast (US$ Million) (2019 – 2033)

15.1.2.1. By VEHICLE

15.1.2.2. By Application

15.1.2.3. By Resin

15.1.2.4. By SUBSTRATE

15.1.2.5. By FORM

15.1.2.6. By END USER

15.1.2.7. By Country

15.1.2.7.1. Brazil

15.1.2.7.2. Argentina

15.1.2.7.3. Colombia

15.1.2.7.4. Rest of South America

16. Competition Landscape

16.1. Global Electric Vehicle

Adhesives Market Competition Matrix & Benchmarking, by Leading Players /

Innovators / Emerging Players / New Entrants

16.2. Global Electric Vehicle

Adhesives Market Competition White Space Analysis, By Resin

16.3. Global Electric Vehicle

Adhesives Market Competition Heat Map Analysis, By Resin

16.4. Global Electric Vehicle

Adhesives Market Concentration & Company Market Shares (%) Analysis, 2022

17. Company Profiles

17.1.

Sika AG (Switzerland)

17.1.1. Company Overview & Key Stats

17.1.2. Financial Performance & KPIs

17.1.3. Product Portfolio

17.1.4. Business Strategy & Recent

Developments

* Similar details would be provided

for all the players mentioned below

17.2. Ashland (US)

17.3. H.B. Fuller

(US)

17.4. Permabond (UK)

17.5. 3M (US)

17.6. L&L

Products (US)

17.7. Jowat SE

(Germany)

17.8. PPG Industries

(US)

17.9. Henkel

(Germany),

17.10. Wacker Chemie

AG (Germany)

17.11. Bostik SA – An

Arkema company (France)

17.12. Others

18. Research

Methodology

18.1. External Transportations /

Databases

18.2. Internal Proprietary Database

18.3. Primary Research

18.4. Secondary Research

18.5. Assumptions

18.6. Limitations

18.7. Report FAQs

19. Research Findings & Conclusion

Quality Assurance Process

- We Market Research’s Quality Assurance program strives to deliver superior value to our clients.

We Market Research senior executive is assigned to each consulting engagement and works closely with the project team to deliver as per the clients expectations.

Market Research Process

We Market Research monitors 3 important attributes during the QA process- Cost, Schedule & Quality. We believe them as a critical benchmark in achieving a project’s success.

To mitigate risks that can impact project success, we deploy the follow project delivery best practices:

- Project kickoff meeting with client

- Conduct frequent client communications

- Form project steering committee

- Assign a senior SR executive as QA Executive

- Conduct internal editorial & quality reviews of project deliverables

- Certify project staff in SR methodologies & standards

- Monitor client satisfaction

- Monitor realized value post-project

Case Study- Automotive Sector

One of the key manufacturers of automotive had plans to invest in electric utility vehicles. The electric cars and associated markets being a of evolving nature, the automotive client approached We Market Research for a detailed insight on the market forecasts. The client specifically asked for competitive analysis, regulatory framework, regional prospects studied under the influence of drivers, challenges, opportunities, and pricing in terms of revenue and sales (million units).

Solution

The overall study was executed in three stages, intending to help the client meet its objective of precisely understanding the entire market before deciding on an investment. At first, secondary research was conducted considering political, economic, social, and technological parameters to get a gist of the various aspects of the market. This stage of the study concluded with the derivation of drivers, opportunities, and challenges. It also laid substantial emphasis on understanding and collecting data not only on a global scale but also on the regional and country levels. Data Extraction through Primary Research

The second stage involved primary research in which several market players and automotive parts suppliers were contacted to study their viewpoint concerning the development of their market and production capacity, clientele, and product line. This stage concluded in a brief understanding of the competitive ecosystem and also glanced through the strategies and pricing of the companies profiled.

Market Estimates and Forecast

In the final stage of the study, market forecasts for the electric utility were derived using multiple market engineering approaches. This data helped the client to get an overview of the market and accelerate the process of investment.

Case Study- ICT Sector

Business process outsourcing, being one of the lucrative markets from both supply- and demand- side, has appealed to various companies. One of the prominent corporations based out of Japan approached us with their requirements regarding the scope of the procurement outsourcing market for around 50 countries. Additionally, the client also sought key players operating in the market and their revenue breakdown in terms of region and application.

Business Solution

An exhaustive market study was conducted based on primary and secondary research that involved factors such as labor costs in various countries, skilled and technical labors, manufacturing scenario, and their respective contributions in the global GDP. A comparative study of the market was conducted from both supply- and demand side, with the supply-side comprising of notable companies, such as GEP, Accenture, and others, that provide these services. On the other hand, large manufacturing companies from them demand-side were considered that opt for these services.

Conclusion

The report aided the client in understanding the market trends, including country-level business scenarios, consumer behavior, and trends in 50 countries. The report also provided financial insights of crucial players and detailed market estimations and forecasts till 2033.

Frequently Asked Questions

What is the market size of Electric Vehicle Adhesives Market in 2024?

Electric Vehicle Adhesives Market was valued at USD 2.46 Billion in 2024.

What is the growth rate for the Electric Vehicle Adhesives Market?

Electric Vehicle Adhesives Market size will increase at approximate CAGR of 20.62% during the forecasted period.

Which are the top companies operating within the market?

Major companies operating within the Electric Vehicle Adhesives Market Are Sika AG (Switzerland), Ashland (US), H.B. Fuller (US), Permabond (UK), 3M (US), L&L Products (US), Jowat SE (Germany), PPG Industries (US), Henkel (Germany), Wacker Chemie AG (Germany), Bostik SA – An Arkema company (France) and Other.

Which region dominates the Electric Vehicle Adhesives Market?

North America dominates the market with an active share of 46%.

}})

Select a license type that suits your business needs

US $3499

Only Three Thousand Four Hundred Ninety Nine US dollar

- 1 User access

- 15% Additional Free Customization

- Free Unlimited post-sale support

- 100% Service Guarantee until achievement of ROI

US $4499

Only Four Thousand Four Hundred Ninety Nine US dollar

- 5 Users access

- 25% Additional Free Customization

- Access Report summaries for Free

- Guaranteed service

- Dedicated Account Manager

- Discount of 20% on next purchase

- Get personalized market brief from Lead Author

- Printing of Report permitted

- Discount of 20% on next purchase

- 100% Service Guarantee until achievement of ROI

US $5499

Only Five Thousand Four Hundred Ninety Nine US dollar

- Unlimited User Access

- 30% Additional Free Customization

- Exclusive Previews to latest or upcoming reports

- Discount of 30% on next purchase

- 100% Service Guarantee until achievement of ROI