Artificial Pancreas Device System Market Analysis by Device Type (Threshold Suspended Device System, Control to Range (CTR) System, Control to Target(CTT) System), by Treatment Type (Bi-hormonal, Insulin Only, Hybrid), by End User (Hospitals, Medical, Centers) and by Region: Global Forecast, 2024 - 2033

- PUBLISHED ON

- 2023-01-05

- NO OF PAGES

- 273

- CATEGORY

- Healthcare & Life Sciences

Market Overview

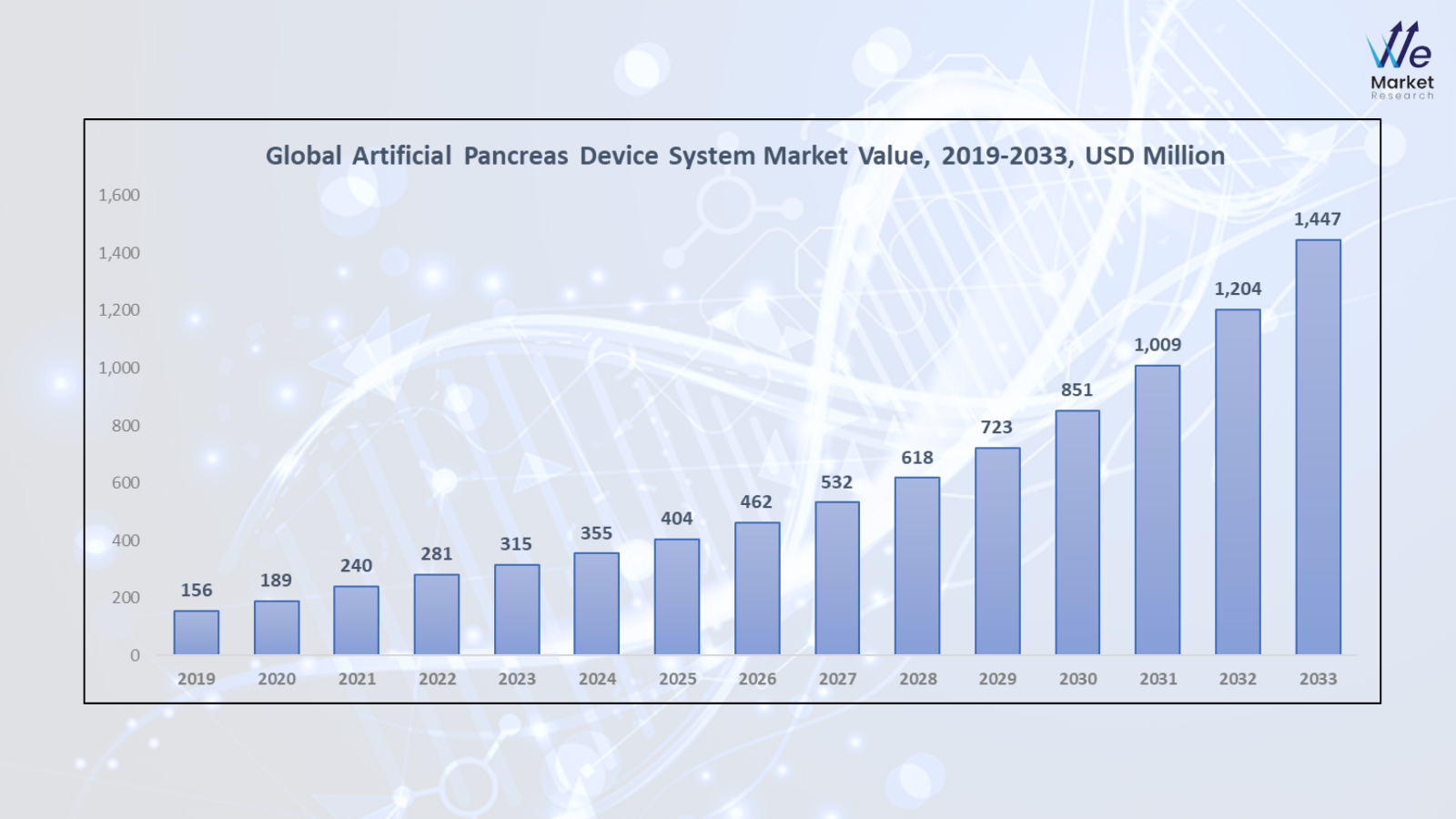

The Artificial Pancreas Device System

market is predicted to develop at a compound annual growth rate (CAGR) of 8.22%

from 2024 to 2033, when it is projected to reach USD 1,512 Million, based on an

average growth pattern. The market is estimated to reach a value of USD 360 Million

in 2024.

SOURCE: We Market Research

The Artificial

Pancreas Device System is a cutting-edge medical device used to control blood

sugar levels in diabetics. It replicates the actions of a functional pancreas

by combining automated insulin delivery with continuous glucose monitoring. In

order to provide accurate management and lower the risk of hypo- and

hyperglycemia, APDS+ measures blood glucose levels in real-time and modifies

insulin delivery accordingly. By reducing the strain of continuous observation

and manual insulin injection, this ground-breaking device improves the quality

of life for patients and presents a viable way to better manage diabetes and

achieve improved health outcomes.

Multiple factors

are driving the market for Artificial Pancreas Device System (APDS). The need

for sophisticated diabetes management solutions is fueled, first and foremost,

by the growing incidence of diabetes worldwide. Adoption is also influenced by

growing knowledge of the advantages of APDS, such as better glycemic control

and a lower risk of problems. The accessibility and use of APDS are improved by

technological developments such as downsizing and improved connectivity.

Policies that facilitate reimbursement and favorable regulatory frameworks also

promote market expansion. The requirement for ongoing glucose monitoring and

the increasing emphasis on individualized healthcare are further factors

driving market growth. Together, these factors are fueling the APDS market's

expansion.

Market Scope

|

Report Attributes |

Description |

|

Market Size in 2024 |

USD 360 Million |

|

Market Forecast in 2033 |

USD 1,512 Million |

|

CAGR % 2024-2033 |

8.22% |

|

Base Year |

2023 |

|

Historic Data |

2016-2022 |

|

Forecast Period |

2024-2033 |

|

Report USP

|

Production, Consumption, company share, company

heatmap, company production capacity, growth factors and more |

|

Segments Covered |

By Device Type, by

Treatment Type, by End User and By Region |

|

Regional Scope |

North America, Europe, APAC, South America and Middle

East and Africa |

|

Country Scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Benelux; Nordic

Countries; Russia; China; India; Japan; South Korea; Australia; Indonesia;

Thailand; Mexico; Brazil; Argentina; Saudi Arabia; UAE; Egypt; South Africa;

Nigeria |

Artificial Pancreas Device System Industry: Dynamics

& Restrains

Market Drivers

The increasing

incidence of diabetes worldwide - The

increasing global prevalence of diabetes is largely responsible for the growth

of the artificial pancreas device market. Modern methods are increasingly

needed to effectively manage diabetes since the condition is spreading more and

more. Artificial pancreas systems offer a novel approach by automating insulin

delivery through continuous glucose monitoring, hence enhancing glycemic

control and reducing the likelihood of problems. The increased prevalence of

diabetes is driving a need for innovative technologies, such artificial

pancreas devices. Patients and healthcare professionals are searching for more

effective diabetes management alternatives, which is driving market expansion.

Patient

Preference for Convenience and Lifestyle Integration - The market for artificial pancreas devices systems is mostly driven

by patient preferences for ease and lifestyle integration. Patients can lead

more flexible lifestyles while still maintaining good glucose control thanks to

these devices, which provide a more efficient and minimally intrusive approach

to diabetes care. Artificial pancreas systems, with features like automatic insulin

delivery and continuous glucose monitoring, ease the strain of constant

monitoring and manual insulin administration, improving convenience and quality

of life for diabetics. The market for artificial pancreas systems is expanding

and progress in diabetes management technology is being driven by patients'

increasing preference for comfort and seamless integration into their everyday

routines.

Market restrains

The high cost of

devices - The Artificial Pancreas Device System

Market is significantly constrained by the high cost of the devices. These

cutting-edge devices frequently have high upfront costs associated with

purchase, installation, and upkeep. For many patients, especially those with

little financial resources or inadequate insurance coverage, such fees may be

prohibitive. Budgetary restrictions may also deter healthcare organizations and

providers from investing in artificial pancreas technology. Therefore, the cost

barrier prevents a larger patient population from benefiting from sophisticated

diabetes care options, thereby impeding market growth and limiting the adoption

and accessibility of these game-changing technologies.

We Market

Research: Artificial Pancreas Device

System Dashboard

Our marketing platform offers a comprehensive dashboard that provides clients with valuable insights into market trends over the years. Included below is a sample image of our dashboard, and specific PDF logins will be furnished to grant access to this insightful tool.

Artificial Pancreas Device System Segmentation

Market- By Device Type Analysis

By Device Type, the Artificial Pancreas Device System Market is Categories into Threshold Suspended Device System, Control to Range (CTR) System, Control to Target(CTT) System. The Control to Range (CTR) System segment accounts for the largest share of around 40% in 2024.

The market segment of the Artificial

Pancreas Device System Market is driven by the Control to Range (CTR) System's

ability to provide customized glucose control within a predetermined range,

providing patients with greater stability and flexibility in managing their

diabetes. Patient satisfaction is increased and the risk of hypo- or

hyperglycemia episodes is reduced with this adaptable approach.

The

following segments are part of an in-depth analysis of the global Artificial

Pancreas Device System market:

|

Market Segments |

|

|

By Treatment Type |

·

Bi-hormonal ·

Insulin Only ·

Hybrid |

|

By End-Users |

·

Hospitals ·

Medical ·

Centers |

Artificial Pancreas Device System Industry: Regional Analysis

North America Market Forecast

North America dominate the Artificial Pancreas Device System Market with the highest revenue generating market with share of more than 49%. The market for artificial pancreas devices (APDS) in North America is driven by the region's high diabetes prevalence, advanced healthcare system, and advantageous reimbursement guidelines. The adoption of APDS is accelerated by the presence of significant market players and research institutions, which is fueled by growing awareness and technological improvements.

Europe Market Statistics

Europe is the

second-largest market for Artificial Pancreas Device System. The number of

people with diabetes is rising across Europe, and the benefits of APDS are

becoming more widely known, accompanied by encouraging government initiatives.

Research and development expenditures as well as advantageous regulatory

frameworks encourage the region's adoption of cutting-edge diabetes treatment

technologies, which in turn propels the expansion of the APDS market.

Asia Pacific Market Forecasts

Asia Pacific is expected

to be the fastest-growing market for Artificial Pancreas Device System during

the forecast period. The Asia Pacific region's rising diabetes prevalence has

been attributed to both rapid increases in healthcare spending and

technological advancements. As a result of government initiatives and raised

awareness, APDS is being adopted in China, India, and Japan, demonstrating the

region's growing significance in the global APDS market.

Key Market Players

The Artificial

Pancreas Device System Market is dominated by a few large companies, such as

·

Cellnovo Group SA

·

DreaMed Diabetes Ltd.

·

Beta Bionics, Inc.

·

Bigfoot Biomedical, Inc.

·

Insulet Corporation

·

Medtronic plc

·

Admetsys Corporation

·

Diabeloop SA

·

TypeZero Technologies LLC

·

Tandem Diabetes Care, Inc.

·

Others

Recent Developments:

·

June 2020, Tandem Diabetes

Care, Inc. and Abbott Laboratories have a distribution arrangement that allows

Tandem to sell its products in a number of foreign regions. Tandem was able to

reach a wider consumer base and increase its market presence thanks to the

deal.

1.

Global

Artificial Pancreas Device System Market Introduction and Market Overview

1.1. Objectives of the Study

1.2. Global Artificial Pancreas

Device System Market Scope and Market Estimation

1.2.1. Global Artificial Pancreas

Device System Overall Market Size, Revenue (US$ Mn), Market CAGR (%), Market

forecast (2023 - 2033)

1.2.2. Global Artificial Pancreas

Device System Market Revenue Share (%) and Growth Rate (Y-o-Y) from 2019 - 2033

1.3. Market Segmentation

1.3.1. Component of Global Artificial

Pancreas Device System Market

1.3.2. Technology of Global Artificial

Pancreas Device System Market

1.3.3. End-user of Global Artificial

Pancreas Device System Market

1.3.4. Region of Global Artificial

Pancreas Device System Market

2.

Executive Summary

2.1. Global Artificial Pancreas Device System Market Industry Trends under

COVID-19 Outbreak

2.1.1. Global COVID-19 Status Overview

2.1.2. Influence of COVID-19 Outbreak

on Global Artificial Pancreas Device

System Market Industry Development

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Limitations

2.2.3. Opportunities

2.2.4. Impact Analysis of Drivers and

Restraints

2.3. Pricing Trends Analysis &

Average Selling Prices (ASPs)

2.4. Key Mergers & Acquisitions,

Expansions, JVs, Funding / VCs, etc.

2.5. Porter’s Five Forces Analysis

2.5.1. Bargaining Power of Suppliers

2.5.2. Bargaining Power of Buyers

2.5.3. Threat of Substitutes

2.5.4. Threat of New Entrants

2.5.5. Competitive Rivalry

2.6. Value Chain / Ecosystem Analysis

2.7. Russia-Ukraine War Impacts

Analysis

2.8. Economic Downturn Analysis

2.9. Market Investment Opportunity

Analysis (Top Investment Pockets), By Segments & By Region

3.

Global Artificial Pancreas

Device System Market Estimates &

Historical Trend Analysis (2019 - 2022)

4.

Global Artificial Pancreas

Device System Market Estimates &

Forecast Trend Analysis, by DEVICE TYPE

4.1. Global Artificial Pancreas

Device System Market Revenue (US$ Mn) Estimates and Forecasts, by DEVICE TYPE,

2019 to 2033

4.1.1. Threshold Suspended Device

System

4.1.2. Control to Range (CTR) System

4.1.3. Control to Target(CTT) System

5.

Global Artificial Pancreas

Device System Market Estimates &

Forecast Trend Analysis, by Treatment Type

5.1. Global Artificial Pancreas Device

System Market Revenue (US$ Mn) Estimates and Forecasts, by Treatment Type, 2019

to 2033

5.1.1. Bi-hormonal

5.1.2. Insulin Only

5.1.3. Hybrid

6.

Global Artificial Pancreas

Device System Market Estimates &

Forecast Trend Analysis, by End-user

6.1. Global Artificial Pancreas Device

System Market Revenue (US$ Mn) Estimates and Forecasts, by End-user, 2019 to 2033

6.1.1. Hospitals

6.1.2. Medical

6.1.3. Centers

7.

Global Artificial Pancreas

Device System Market Estimates &

Forecast Trend Analysis, by Region

7.1. Global Artificial Pancreas

Device System Market Revenue (US$ Mn) Estimates and Forecasts, by Region, 2019

to 2033

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

8.

North

America Artificial Pancreas Device System Market: Estimates & Forecast Trend Analysis

8.1.

North

America Artificial Pancreas Device System Market Assessments & Key Findings

8.1.1. North America Artificial

Pancreas Device System Market Introduction

8.1.2. North America Artificial

Pancreas Device System Market Size Estimates and Forecast (US$ Million) (2019 –

2033)

8.1.2.1. By DEVICE TYPE

8.1.2.2. By Treatment Type

8.1.2.3. By End-user

8.1.2.4. By Country

8.1.2.4.1. The U.S.

8.1.2.4.2. Canada

8.1.2.4.3. Mexico

9.

Europe

Artificial Pancreas Device System Market: Estimates & Forecast Trend Analysis

9.1. Europe Artificial Pancreas

Device System Market Assessments & Key Findings

9.1.1. Europe Artificial Pancreas

Device System Market Introduction

9.1.2. Europe Artificial Pancreas

Device System Market Size Estimates and Forecast (US$ Million) (2019 – 2033)

9.1.2.1. By DEVICE TYPE

9.1.2.2. By Treatment Type

9.1.2.3. By End-user

9.1.2.4.

By

Country

9.1.2.4.1. Germany

9.1.2.4.2. U.K.

9.1.2.4.3. France

9.1.2.4.4. Italy

9.1.2.4.5. Spain

9.1.2.4.6. Russia

9.1.2.4.7. Rest of Europe

10. Asia Pacific Artificial

Pancreas Device System Market:

Estimates & Forecast Trend Analysis

10.1. Asia Pacific Market Assessments

& Key Findings

10.1.1. Asia Pacific Artificial Pancreas

Device System Market Introduction

10.1.2. Asia Pacific Artificial Pancreas

Device System Market Size Estimates and Forecast (US$ Million) (2019 – 2033)

10.1.2.1. By DEVICE TYPE

10.1.2.2. By Treatment Type

10.1.2.3. By End-user

10.1.2.4. By Country

10.1.2.4.1. China

10.1.2.4.2. Japan

10.1.2.4.3. India

10.1.2.4.4. Australia

10.1.2.4.5. South Korea

10.1.2.4.6. ASEAN

10.1.2.4.7. Rest of Asia Pacific

11. Middle East & Africa Artificial

Pancreas Device System Market: Estimates

& Forecast Trend Analysis

11.1. Middle East & Africa Market

Assessments & Key Findings

11.1.1. Middle

East & Africa Artificial

Pancreas Device System Market Introduction

11.1.2. Middle

East & Africa Artificial

Pancreas Device System Market Size Estimates and Forecast (US$ Million) (2019 –

2033)

11.1.2.1. By DEVICE TYPE

11.1.2.2. By Treatment Type

11.1.2.3. By End-user

11.1.2.4. By Country

11.1.2.4.1. U.A.E.

11.1.2.4.2. Saudi Arabia

11.1.2.4.3. Egypt

11.1.2.4.4. South Africa

11.1.2.4.5. Rest of Middle East & Africa

12. South America

Artificial Pancreas Device System Market:

Estimates & Forecast Trend Analysis

12.1. South America Market Assessments

& Key Findings

12.1.1. South America Artificial

Pancreas Device System Market Introduction

12.1.2. South America Artificial

Pancreas Device System Market Size Estimates and Forecast (US$ Million) (2019 –

2033)

12.1.2.1. By DEVICE TYPE

12.1.2.2. By Treatment Type

12.1.2.3. By End-user

12.1.2.4. By Country

12.1.2.4.1. Brazil

12.1.2.4.2. Argentina

12.1.2.4.3. Colombia

12.1.2.4.4. Rest of South America

13. Competition Landscape

13.1. Global Artificial Pancreas

Device System Market Competition Matrix & Benchmarking, by Leading Players

/ Innovators / Emerging Players / New Entrants

13.2. Global Artificial Pancreas

Device System Market Competition White Space Analysis, By End-user

13.3. Global Artificial Pancreas

Device System Market Competition Heat Map Analysis, By End-user

13.4. Global Artificial Pancreas

Device System Market Concentration & Company Market Shares (%) Analysis,

2022

14. Company Profiles

14.1.

Cellnovo Group SA

14.1.1. Company Overview & Key Stats

14.1.2. Financial Performance & KPIs

14.1.3. Product Portfolio

14.1.4. Business Strategy & Recent

Developments

* Similar details would be provided

for all the players mentioned below

14.2. DreaMed

Diabetes Ltd.

14.3. Beta Bionics,

Inc.

14.4. Bigfoot

Biomedical, Inc.

14.5. Insulet

Corporation

14.6. Medtronic plc

14.7. Admetsys

Corporation

14.8. Diabeloop SA

14.9. TypeZero

Technologies LLC

14.10. Tandem

Diabetes Care, Inc.

14.11. Others

15. Research

Methodology

15.1. External Transportations /

Databases

15.2. Internal Proprietary Database

15.3. Primary Research

15.4. Secondary Research

15.5. Assumptions

15.6. Limitations

15.7. Report FAQs

16. Research Findings & Conclusion

Quality Assurance Process

- We Market Research’s Quality Assurance program strives to deliver superior value to our clients.

We Market Research senior executive is assigned to each consulting engagement and works closely with the project team to deliver as per the clients expectations.

Market Research Process

We Market Research monitors 3 important attributes during the QA process- Cost, Schedule & Quality. We believe them as a critical benchmark in achieving a project’s success.

To mitigate risks that can impact project success, we deploy the follow project delivery best practices:

- Project kickoff meeting with client

- Conduct frequent client communications

- Form project steering committee

- Assign a senior SR executive as QA Executive

- Conduct internal editorial & quality reviews of project deliverables

- Certify project staff in SR methodologies & standards

- Monitor client satisfaction

- Monitor realized value post-project

Case Study- Automotive Sector

One of the key manufacturers of automotive had plans to invest in electric utility vehicles. The electric cars and associated markets being a of evolving nature, the automotive client approached We Market Research for a detailed insight on the market forecasts. The client specifically asked for competitive analysis, regulatory framework, regional prospects studied under the influence of drivers, challenges, opportunities, and pricing in terms of revenue and sales (million units).

Solution

The overall study was executed in three stages, intending to help the client meet its objective of precisely understanding the entire market before deciding on an investment. At first, secondary research was conducted considering political, economic, social, and technological parameters to get a gist of the various aspects of the market. This stage of the study concluded with the derivation of drivers, opportunities, and challenges. It also laid substantial emphasis on understanding and collecting data not only on a global scale but also on the regional and country levels. Data Extraction through Primary Research

The second stage involved primary research in which several market players and automotive parts suppliers were contacted to study their viewpoint concerning the development of their market and production capacity, clientele, and product line. This stage concluded in a brief understanding of the competitive ecosystem and also glanced through the strategies and pricing of the companies profiled.

Market Estimates and Forecast

In the final stage of the study, market forecasts for the electric utility were derived using multiple market engineering approaches. This data helped the client to get an overview of the market and accelerate the process of investment.

Case Study- ICT Sector

Business process outsourcing, being one of the lucrative markets from both supply- and demand- side, has appealed to various companies. One of the prominent corporations based out of Japan approached us with their requirements regarding the scope of the procurement outsourcing market for around 50 countries. Additionally, the client also sought key players operating in the market and their revenue breakdown in terms of region and application.

Business Solution

An exhaustive market study was conducted based on primary and secondary research that involved factors such as labor costs in various countries, skilled and technical labors, manufacturing scenario, and their respective contributions in the global GDP. A comparative study of the market was conducted from both supply- and demand side, with the supply-side comprising of notable companies, such as GEP, Accenture, and others, that provide these services. On the other hand, large manufacturing companies from them demand-side were considered that opt for these services.

Conclusion

The report aided the client in understanding the market trends, including country-level business scenarios, consumer behavior, and trends in 50 countries. The report also provided financial insights of crucial players and detailed market estimations and forecasts till 2033.

}})

Select a license type that suits your business needs

US $3750

Only Three Thousand Seven Hundred Fifty US dollar

- 1 User access

- 15% Additional Free Customization

- Free Unlimited post-sale support

- 100% Service Guarantee until achievement of ROI

US $4750

Only Four Thousand Seven Hundred Fifty US dollar

- 5 Users access

- 25% Additional Free Customization

- Access Report summaries for Free

- Guaranteed service

- Dedicated Account Manager

- Discount of 20% on next purchase

- Get personalized market brief from Lead Author

- Printing of Report permitted

- Discount of 20% on next purchase

- 100% Service Guarantee until achievement of ROI

US $5750

Only Five Thousand Seven Hundred Fifty US dollar

- Unlimited User Access

- 30% Additional Free Customization

- Exclusive Previews to latest or upcoming reports

- Discount of 30% on next purchase

- 100% Service Guarantee until achievement of ROI